-----------------------------------------------------------------------------------

Become a Member

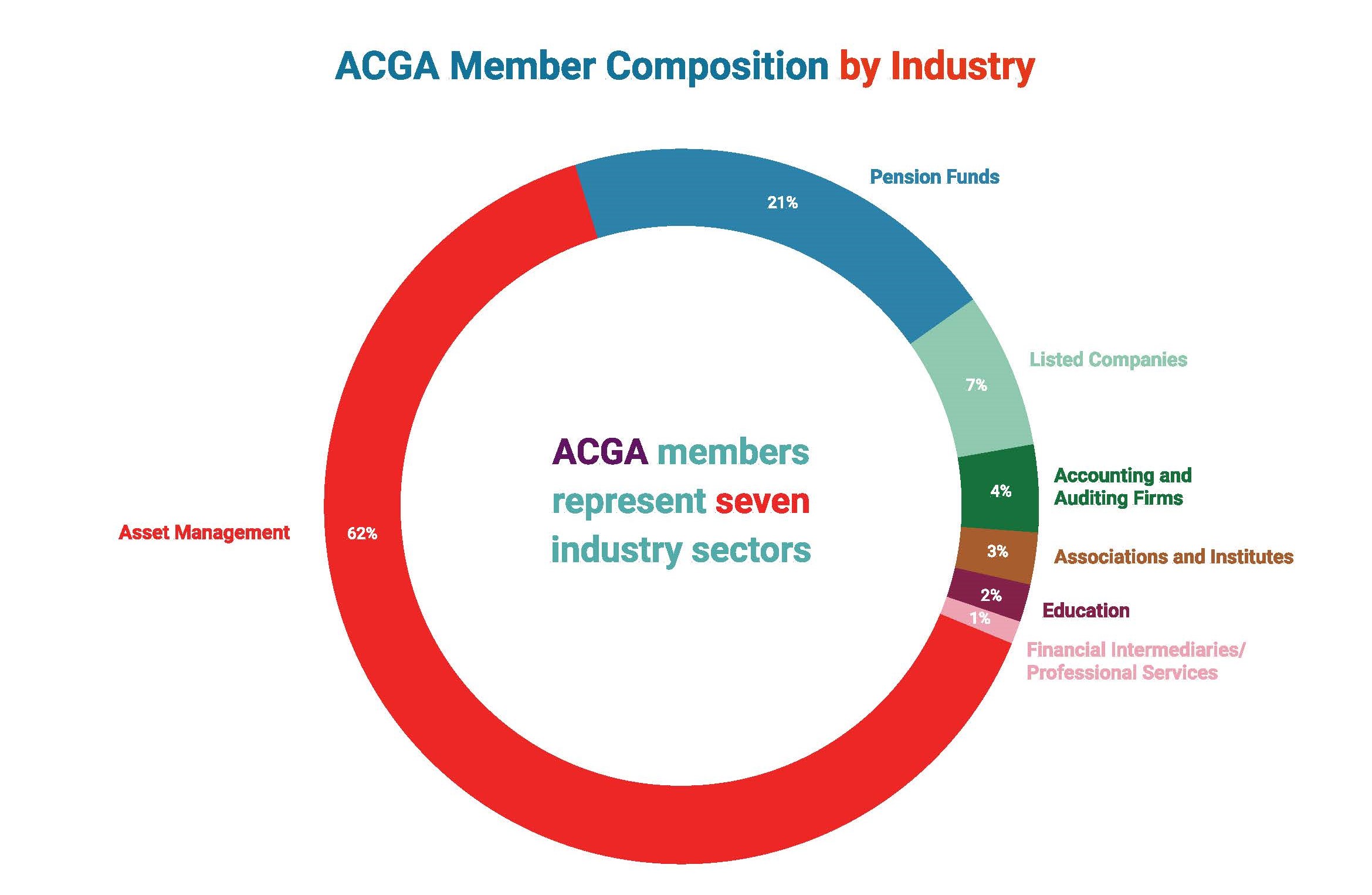

ACGA has different categories of membership.

Please click on the link for the membership booklet for your sector, as the benefits offered differ:

Institutional Investors

Corporates

Auditors

Financial Services

Investor Associations

Business Associations

-----------------------------------------------------------------------------------

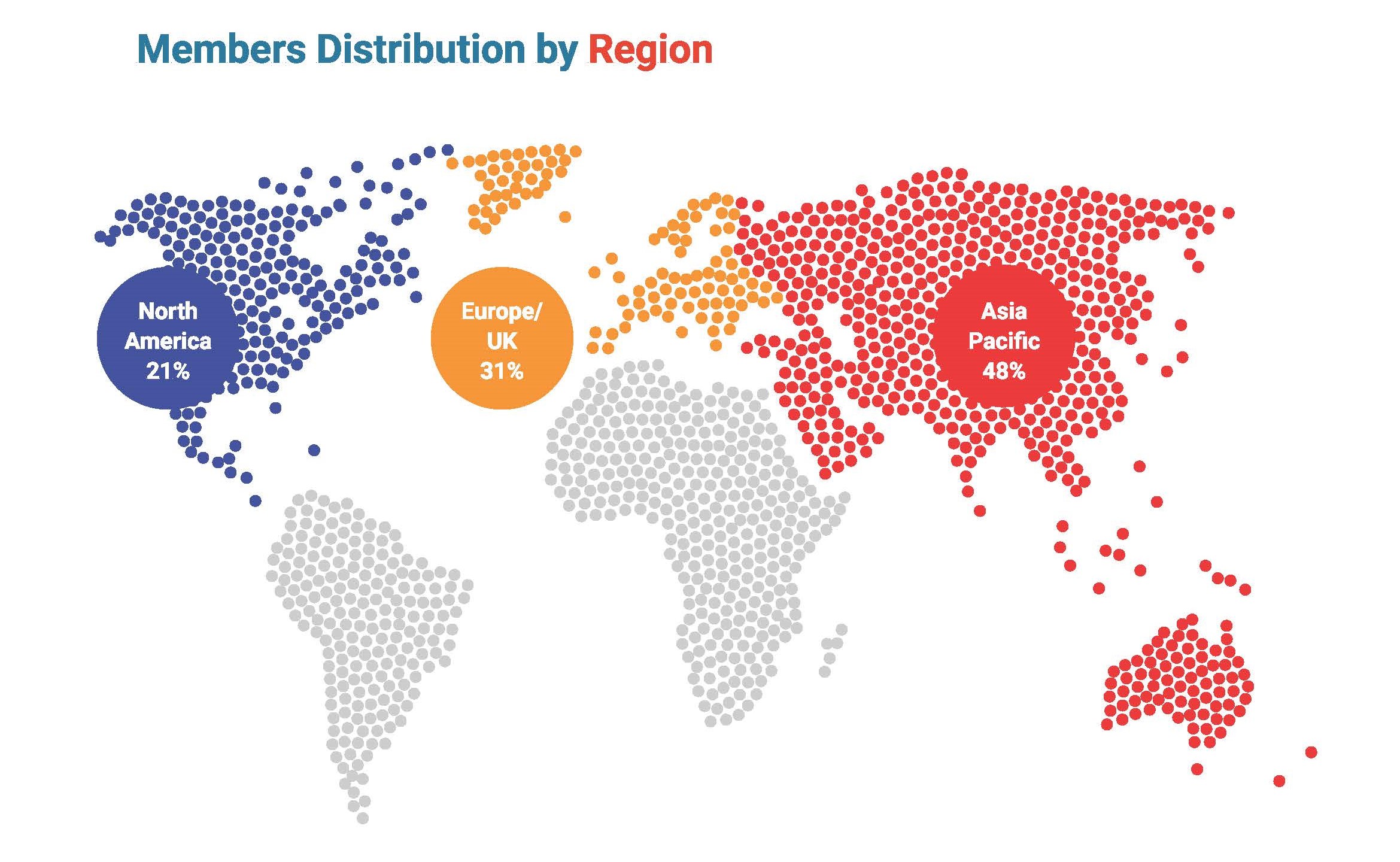

104 members from 22 markets with

total assets under management of more than US$40 trillion

| North America | Europe/UK | Asia-Pacific | ||||

|

|

|

- Aberdeen Investments

- AIA Investment Management

- Align Partners Capital Management

- AllianceBernstein

- Andra AP-fonden (AP2)

- APG Investments Asia

- Asian Development Bank (ADB)

- Asset Management One

- Australian Council of Superannuation Investors (ACSI)

- Aviva Investors

- Baillie Gifford & Co

- BlackRock

- BNP Paribas Asset Management Asia

- Boston Common Asset Management

- British Columbia Investment Management Corp (BCI)

- Bureau of Labor Funds, Ministry of Labor

- California Public Employees' Retirement System (CalPERS)

- California State Teachers' Retirement System (CalSTRS)

- Canada Pension Plan Investment Board (CPPIB)

- Capital Group

- Cathay Financial Holding Co., Ltd.

- CFA Institute

- CLP Holdings

- CLSA

- Columbia Threadneedle Investments

- Deloitte Touche Tohmatsu

- Dimensional Fund Advisors

- Dragon Capital Group

- E Fund Management

- East Capital Group

- Edgbaston Investment Partners

- Effissimo Capital Management

- Elliott Advisors (HK)

- EY

- Federated Hermes

- Fidelity International

- Fidelity Management & Research

- First Financial Holding

- Franklin Templeton

- GAM Investments

- GMO (Grantham Mayo van Otterloo)

- Goldman Sachs Asset Management

- Harris Associates

- HESTA

- HSBC Global Asset Management

- Iclif Executive Education Center

- Impax Asset Management

- Indus Capital Partners

- Invesco Asset Management

- Janus Henderson Investors

- KLP Kapitalforvaltning AS

- Korean Corporate Governance Forum (KCGF)

- KPMG International

- L&G Asset Management

- LIM Advisors

- Los Angeles County Employees Retirement Association (LACERA)

- M&G Investments

- Makena Capital Management

- Manulife Financial Asia

- Matthews Asia

- MFS Investment Management

- National Pension Service

- NEI Investments

- Neuberger Berman

- Nomura Asset Management

- Norges Bank Investment Management (NBIM)

- Northern Trust Asset Management

- Nuveen

- Oasis Management

- Ontario Municipal Employees Retirement System (OMERS)

- Orbis Investments

- Overlook Investments

- Palliser Capital (UK)

- Pension Fund Association

- PGGM Investments

- PharmaEssentia Corporation

- Pictet Group

- Polen Capital

- Prusik Investment Management LLP

- PSP Investments

- PwC

- RAILPEN Investments (RPMI)

- Resona Asset Management

- Robeco

- Sands Capital

- Schroders Investment Management

- Shinhan Asset Management

- Singapore Institute of Directors (SID)

- Solaris Management

- Sumitomo Mitsui DS Asset Management

- Swire Pacific

- T. Rowe Price International

- Taikang Asset Management (Hong Kong) Co. Ltd.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Temasek Holdings (Private) Limited

- TIH Investment Management Pte. Ltd.

- TPC (Tsao Pao Chee)

- TS Financial Holding Co., Ltd

- UBS Asset Management

- UBS SDIC Fund Management Company

- UniSuper

- USS Investment Management

- Vanguard Asset Management

- Zennor Asset Management LLP