China’s new ESG reporting standard leaves room for local elements

by Lake Wang, ACGA

China took a significant step towards addressing its fragmented ESG reporting regulations on 27 May with the release of a draft sustainability reporting framework.

The Ministry of Finance (MOF) high-level draft, titled “Corporate Sustainability Disclosure Standard – Basic Standard” (Basic Standard), follows the structure of IFRS S1 but differs in terms of materiality. It is the first prong of a national sustainability reporting system that the MOF aims to develop by 2030. Other components of the system include a more detailed “Specific Standard” and an “Application Guide”.

In terms of adoption, the MOF only provided initial “considerations” in the explanatory note for the consultation. It ruled out a “one-size-fits-all, mandatory” approach and instead favors a gradual adoption process that begins with voluntary participation by listed companies, without specifying any timelines.

The MOF first floated the idea of “developing a sustainability reporting system” in a 2021 blueprint for the accounting sector. It has since strengthened its relationship with the IFRS Foundation, resulting in the opening of an ISSB office in Beijing in June 2023. It is worth noting that China was one of IFRS’s largest funding providers in 2023, with a total contribution of £4.13m, on par with Germany (£4.13m) and second only to Canada (£10.7m).

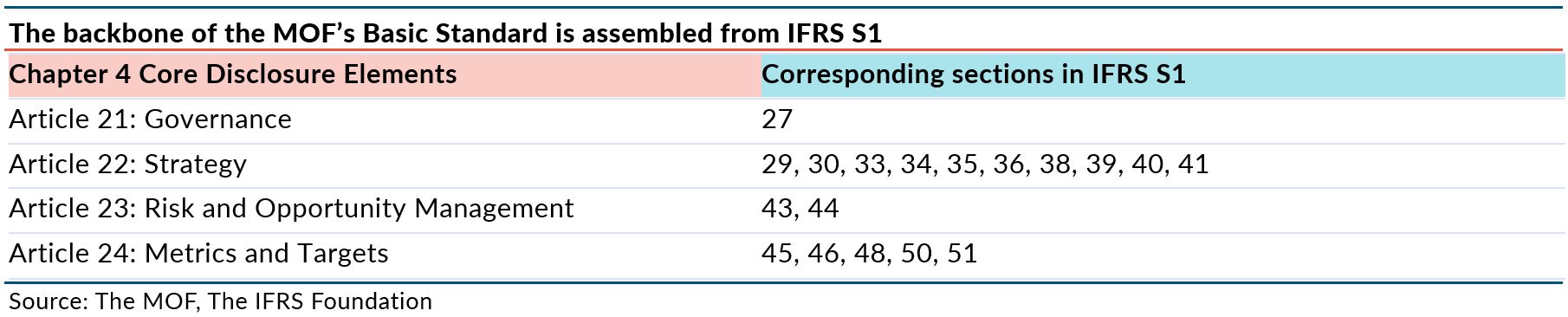

The alignment with IFRS S1 is apparent in Chapter Four, most of which is directly translated from S1. The chapter outlines the “core disclosure elements” in four key areas: Governance, Strategy, Risk and Opportunity Management, and Metrics and Targets. These areas correspond to the four pillars in the “Core Content” section of IFRS S1. One notable omission is scenario analysis. While IFRS S1 encourages companies to disclose whether they conduct scenario analysis, the draft does not mention this analytical tool.

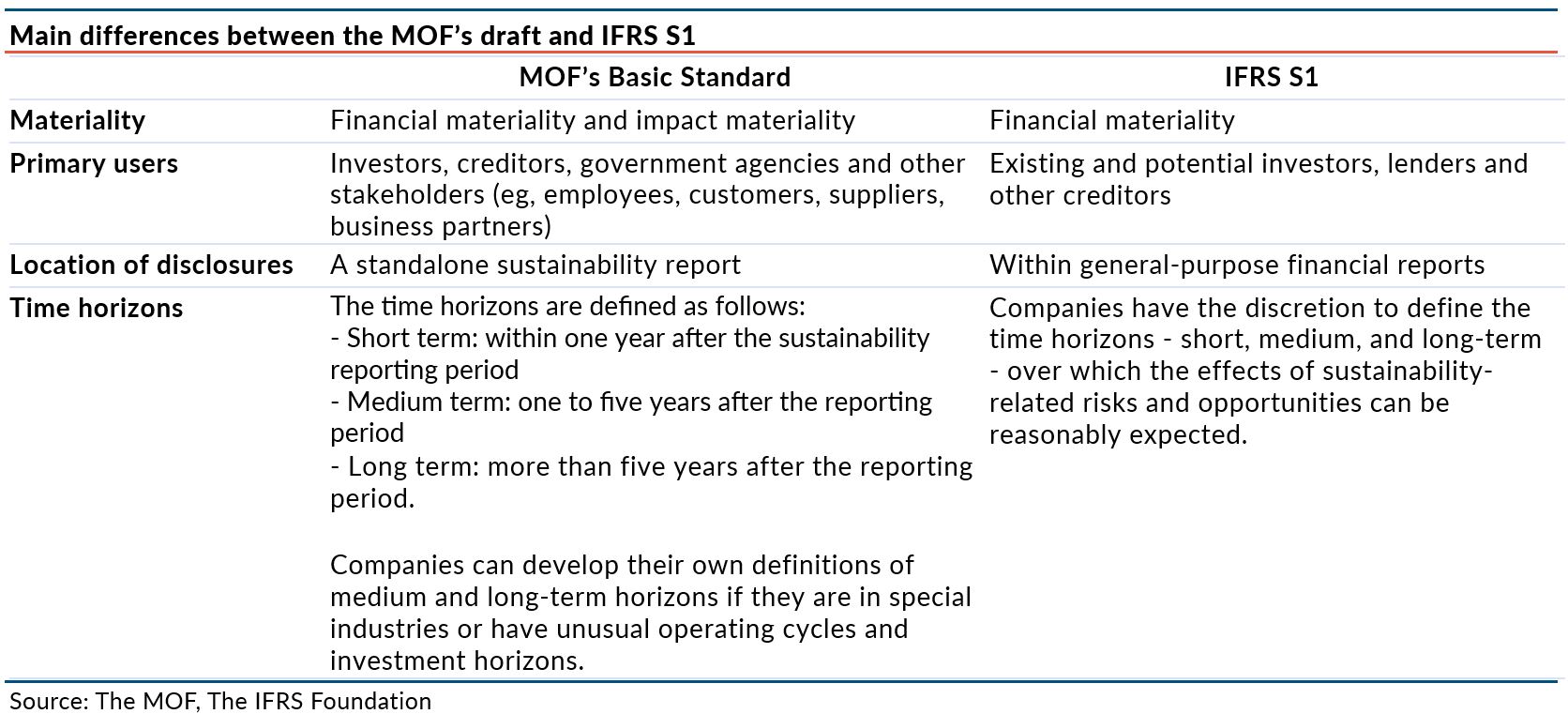

The main deviation from IFRS S1 is on materiality. IFRS S1 focusses on financial materiality, but the MOF draft takes a page from the European playbook to adopt the concept of double materiality. Notably, Article 11 requires companies to evaluate not only the impact of sustainability issues on their own financial position but also the effects of their “corporate activities on the economy, society, and environment.” The draft, however, provides no guidance on how to disclose the broader impact of materiality. Other key differences are highlighted below:

The decision to use double materiality is based on a three-month feasibility study conducted by the MOF. Huang Shizhong, an accounting scholar who sits on the China Accounting Standards Committee under the MOF, disclosed that nearly nine out of ten companies (92%) surveyed opposed the adoption of single materiality.

Another notable feature of the draft framework is the lack of Chinese political catchphrases. Only Article 9 briefly mentions Xi’s “new development philosophy” when explaining the purpose of sustainability disclosure. Huang said that Chinese policy themes such as common prosperity, the “ecological redline”, and information security will be incorporated into the “Specific Standard” at a later stage.

Local characteristics feature prominently in the sustainability reporting rules for listed companies unveiled by the Beijing, Shanghai, and Shenzhen stock exchanges in February 2024. This underscores a key principle of China’s accounting standards convergence: “Convergence does not mean simple homogenization”.

The draft standard, which applies to both listed and non-listed companies, is open for public consultation until 24 June.

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Lake Wang

Lake Wang