Will Taiwan catch the activist bug?

by Lake Wang, ACGA

A shareholder proposal is testing the parameters of investor appetite to effect change at issuers, writes Research Manager Lake Wang

Taiwan has many favourable ingredients for vibrant shareholder activism. It has actively encouraged the practice since its first CG Roadmap in 2013, has a well-established electronic voting system and its stewardship code, introduced in 2016, boasts 150 signatories. Yet amid the dominance of family-controlled companies, there has been a paucity of activist events, particularly those launched by foreign investors.

A break in the drought has come in the form of a shareholder proposal put forward by two asset managers, Hong Kong-based Argyle Street Management and Singapore-listed TIH Limited, which on 18 April 2024 was included on the AGM agenda of Catcher Technology, an electronic casings maker.

The pair hold about 1% of Catcher and are seeking to amend the company’s Articles of Incorporation to enable shareholders, rather than the board, to decide the distribution of cash dividends. This they argue would potentially unlock the company’s NT$ 149 billion (US$ 4.62 billion) cash pile.

The electronic voting took place between 30 April and 27 May 2024 and the AGM is scheduled for 30 May. The investors may not get the outcome they are looking for, but the proposal has had fierce media coverage, putting the spotlight on the role shareholders can play in pressuring issuers to change. Regulators may be quietly hoping that domestic investors take note.

Twists and turns

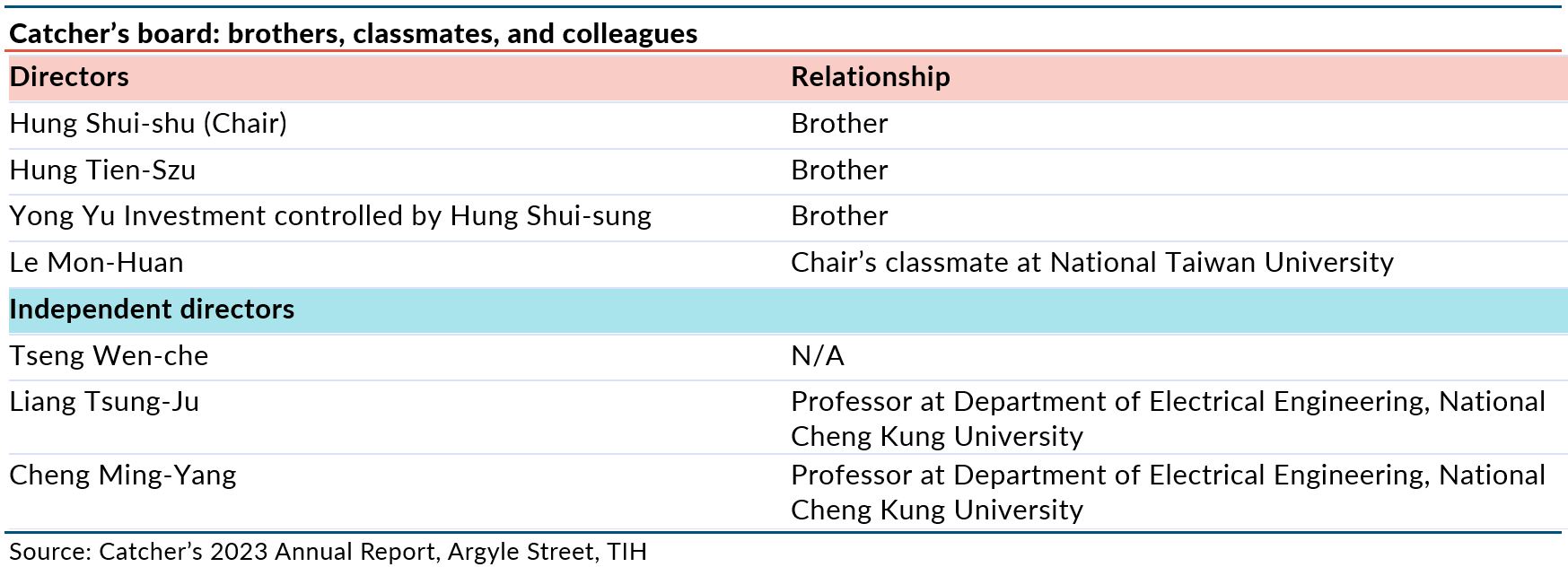

This is the investors’ second bite at the cherry: a year previously the board of Catcher, controlled by three brothers of the Hung family, refused to include the same resolution by the investors in its AGM agenda on semantics. It argued that the proposal touched on two points, rather than one, which would render it foul of the Company Act.

The move drew investor ire at Catcher’s May 2023 AGM. Four shareholders stood up against the board chairman Hung Shui-shu at the meeting, including Argyle Street, TIH, a retail investor, and the Securities and Futures Investor Protection Center (SFIPC), a quasi-governmental organisation devoted to investor protection in Taiwan.

Notably, the SFIPC, which owns shares in every Taiwan-listed company and regularly attends AGMs, argued that the resolution “should be considered as one single proposal” and Catcher’s decision “may potentially violate the Company Act.” The Center later elaborated that the proposal, despite relating to two articles, dealt with the “general topic of the means for reaching resolutions for cash distribution of dividends and reserves to shareholders.”

Catcher however stood its ground. In May 2023, Hung Shui-shu, knowing that the case had been reported to Taiwan’s peak financial regulator Financial Supervisory Commission (FSC), was quoted as saying, “don’t invest if you don’t trust the company.” Implicit in his remark was a typical mindset among local listed companies: that shareholder activists are hostile outsiders intent on controlling the right to manage the company. Shortly afterwards, on 5 June, the company further filed a defamation suit against Allen Wang, CEO of TIH, accusing him of creating and spreading “false” information about the company on dedicated websites.

But in August 2023 the Securities and Futures Bureau (SFB), a subordinate of the FSC, sided with the investors and issued a NT$ 240,000 (around $7500) fine to Hung Shui-shu for a “clear” violation of the Company Act. Catcher is still in the process of appealing against the SFB’s decision.

Domestic players hold the cards

Foreign and domestic institutional investors each hold about one third of Catcher’s shares. The Hung family meanwhile has a combined 13.7% stake, according to the company’s 2023 Annual Report. But while ISS and Glass Lewis have expressed support for the resolution, the swing votes, as Allen Wang told ACGA, are with domestic institutional investors. This cohort rarely votes against management: six out of the nine large local institutional investors we surveyed in our Taiwan chapter of CG Watch 2023 disclosed no votes against at all.

Wang has found it challenging to get campaign messages across to domestic peers, which could explain the silence of domestic institutional investors at Catcher’s 2023 AGM and in the subsequent public debate around the case.

Still, regardless of the voting outcome the resolution has attracted wide media coverage, at times sensational, which has grabbed the attention of the investing public. It may not radically change the activist scene overnight, but domestic investors may get a taste of what is possible.

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Lake Wang

Lake Wang