A boardroom battle, Hong Kong style

by Lake Wang, ACGA

An attempt to unseat the CEO of fashion retailer Giordano puts the spotlight on tactics employed by tycoons in the city to achieve corporate control writes ACGA Research Manager Lake Wang

Giordano International is well-known in Hong Kong for its affordable T-shirts and founder, Jimmy Lai. After Lai sold his entire stake in 1996, the company was widely held, a favourite of institutional investors over the years, including Aberdeen Asset Management and Franklin Templeton.

Such broad-based shareholding, coupled with a sprawling store network, made Giordano a coveted takeover target. Among the companies historically expressing an interest in acquiring the firm were Esprit, Zara and Uniqlo’s owner Fast Retailing.

One Hong Kong family in particular set its sights on the retailer. Billionaire Cheng Yu Tung, the late patriarch of the Cheng family which runs the New World conglomerate, had acquired 20% of Giordano’s shares by the end of 2011.

Ten years later, in June 2022, the Cheng family unsuccessfully offered shareholders an 18% premium on the company’s share price to take over the company. Activist investor David Webb, who at the time owned a 5.79% stake, considered the offer “far below fair value,” and called on shareholders to reject it. The takeover bid collapsed in September 2022 after it failed to receive 50% of shareholder votes, albeit by a small margin.

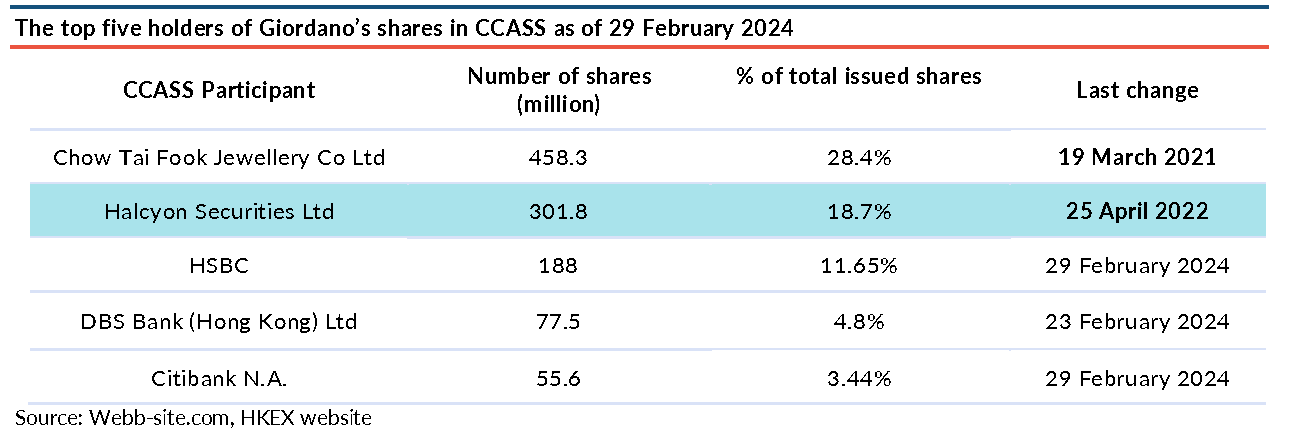

Fast forward to the present and on 3 April a special shareholder meeting requisitioned by the family of Cheng’s son Henry Cheng Kar-shun, who holds a 28.4% stake through Chow Tai Fook Jewellery, is being held at Giordano to oust its CEO, Peter Lau Kwok-kuen.

On 5 February 2024, the Chengs called a special general meeting to replace 70-year-old Lau, who has been CEO since 1994, with Colin Currie “as quickly as possible”. Currie currently works as a consultant for Chow Tai Fook Enterprises, and previously worked at Adidas. The meeting will also see an attempt to appoint two of Henry Cheng’s children, Sonia and Christopher, as non-executive directors (NED) and auditing professional Victor Huang as an independent NED. Huang has been an INED at New Times Energy since June 2020: the Cheng family held a 65% stake in New Times Energy via Max Sun Enterprises as of the end of 2022.

Such a board reshuffling would lead to a significant Cheng presence. After the failed takeover bid in 2022, two directors with connections to the Chengs were appointed to the Giordano board: Patrick Tsang On Yip, then CEO and director of Chow Tai Fook Enterprises, and Jacob Lee Chi Hin, a vice-president at Chow Tai Fook Enterprises.

The upcoming vote

The key to the 3 April boardroom battle to control Giordano, David Webb suggested, lies with the owners of 18.7% of Giordano which are in the custody of a small firm, Halcyon Securities, the brokerage arm of Halcyon Capital.

Halcyon Capital was founded by Derek Chan, an economics teacher-turned-banker who joined the Chengs’ Taifook Securities in 1996. He later headed the firm’s corporate finance arm, and sat on the board with Henry Cheng and Simon Lo, Cheng Yu Tung’s right-hand man. In late 2009, Taifook Securities was acquired by Haitong Securities and rebranded as Haitong International. Derek Chan was on the board of Haitong International until he established Halcyon Capital in August 2012.

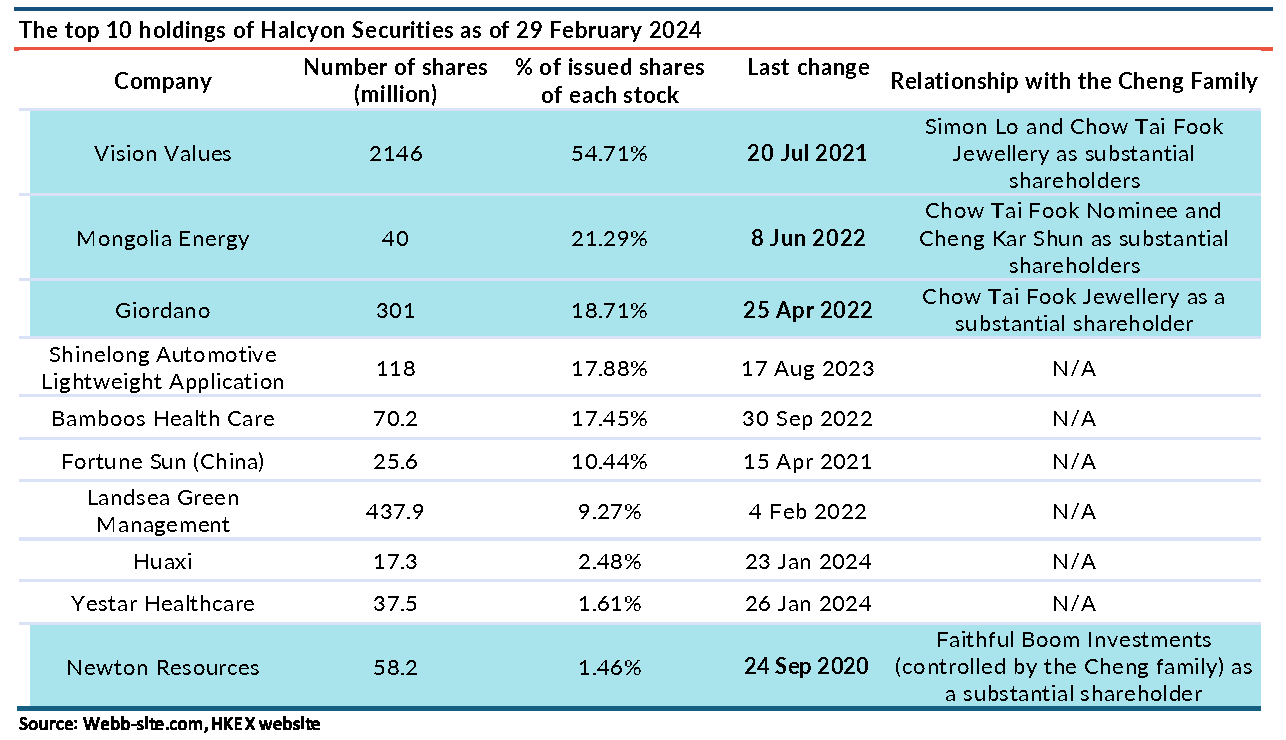

It was also Halcyon Capital who advised the Cheng family on the 2022 takeover bid of Giordano. Its adviserships for the Cheng family also included acquisitions of Integrated Waste Solutions and i-Cable Communications.

Meanwhile, Halcyon Securities stands out as the key warehouse of three stocks ie, Giordano, Vision Values, and the controversial coal miner Mongolia Energy. All of them count the Cheng Family as a substantial shareholder:

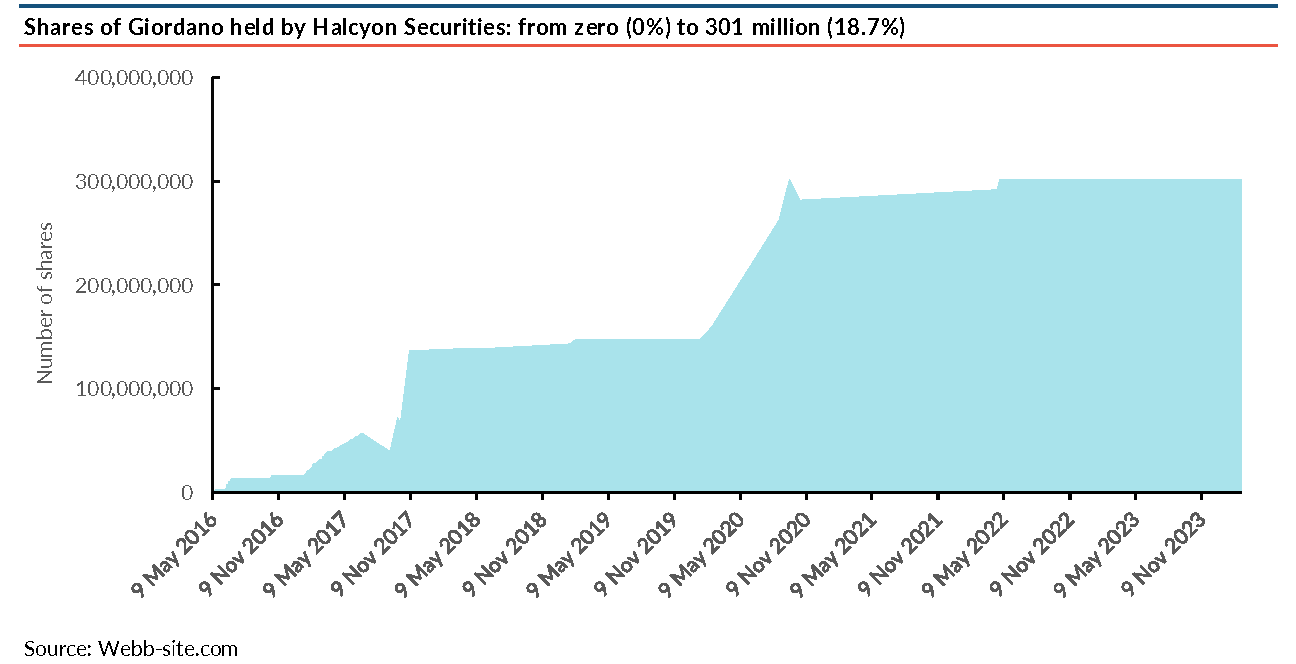

A search of CCASS holdings on Webb-site.com further shows that the majority of Giordano shares held by Halcyon Securities came from Haitong International. From Oct 2017 to Sept 2020, there were four significant transfers ranging from 1.9% to 4.6% (just below the 5% disclosure threshold) of Giordano’s total issued shares.

The Giordano shares at Halcyon have been dormant since 25 April 2022: none of the investors holding these shares have bought more or sold their stakes down in two years.

The vote on 3 April requires 50% to pass. Giordano itself has offered no view on the proposed removal and appointment of directors in the requisition notice.

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Lake Wang

Lake Wang