Retail shareholders: you’re on mute

by Jane Moir, ACGA

Korea is the latest market to move toward virtual AGMs as a permanent fixture just as retail investors get louder in the region, writes ACGA Head of Research Jane Moir

One of the bright spots we identified in our recent CG Watch research is the growing emergence in several markets of retail shareholders as a force to be reckoned with.

From organised shareholder groups in Singapore and YouTube activists in Korea, to the proliferation of campaigns and proposals in Japan, retail investors are increasingly finding a voice. In markets such as Australia, Singapore, and Malaysia, they are also more likely than their institutional peers to turn out in force at AGMs.

The one opportunity they have to challenge the board and management face-to-face is however looking increasingly numbered in the Asia Pacific region. Korea is the latest market to take steps to give issuers greater control over the conduct of AGMs: an amendment to its Commercial Act is currently with lawmakers and would enable companies to take the annual meeting fully online.

It would follow in the footsteps of eight markets of the 12 we follow in the region who have made fully virtual AGMs a permanent fixture by changing laws or regulations. As we wrote last year, several moved quickly to put temporary pandemic measures on a permanent footing without public consultation or investor support. Only India, China and Malaysia have yet to give virtual AGM regimes permanence.

Most legal frameworks require changes to a company’s Articles of Association to allow fully virtual AGMs. While ACGA sees the benefit of technology enabling more shareholders able to attend an annual meeting, we take the view that an in-person meeting is the preferred format, with a hybrid arrangement a good option if the technology allows online shareholders to speak, ask questions and vote in the same way as if they were attending in person. Most laws in the region now give issuers the option to host virtual AGMs as a convention, rather than requiring it as a last resort, and give companies generous discretion as to the precise conduct of the meeting.

Muzzled at the meeting

Investors have shared concerns over the format, technical quality, and limitations of fully virtual AGMs. An online setting enables issuers to control the agenda: shareholders must often submit questions in advance, cannot see other attendees, and must endure lengthy presentations by the board and management with limited time for Q&A, if any. Many have likened the process to a glorified webcast which lacks the interaction, transparency, and candour of a physical setting.

For Korea in particular, the move comes at a time when retail shareholders are proliferating, accounting for nearly two-thirds of stock transactions. Data from the Korea Securities Depository (KSD) released in November 2023 put the figure of retail investors at 14.24m, more than a quarter of the population. In the past five years, the figure has nearly tripled.

Domestic activist investors are meanwhile very much in the spotlight: last year saw Flashlight Capital Partners’ campaign against tobacco producer KT&G to spin off one of its lucrative units, and the successful bid by Align Partners to appoint an independent auditor to the board of SM Entertainment.

Retail warriors

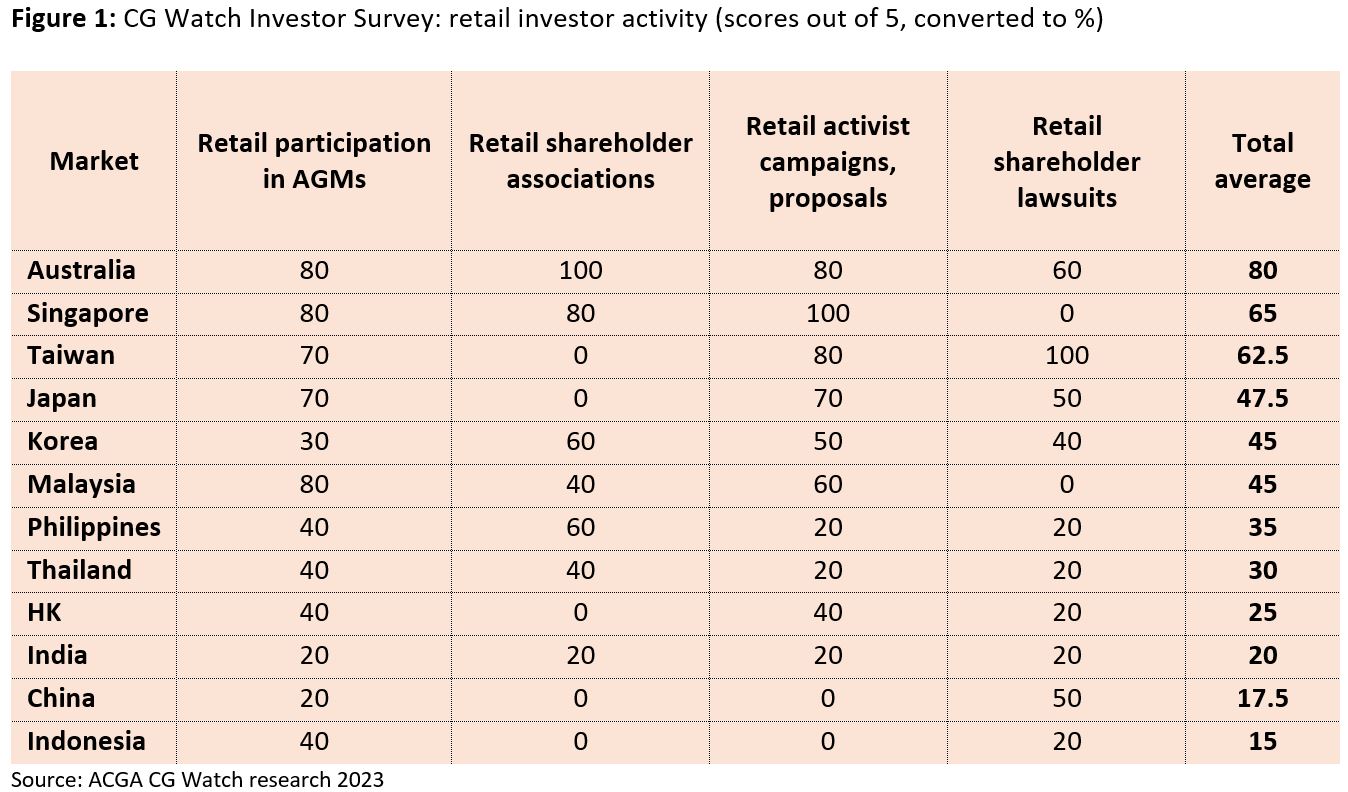

Indeed, Korea ranked among the top five markets in our CG Watch 2023 investor survey when looking at retail participation:

Top scorer Australia saw an increase in campaigns by organisations such as Market Forces and the Australasian Centre for Corporate Responsibility (ACCR) particularly on climate change issues since our last CG Watch, and there have been several retail class actions. Shareholder proposals in Japan are also notably on the rise, reaching a record high in 2023. During the annual meeting season, there were 385 proposals at 90 listed companies, a 237% increase since 2021.

Organisations such as the Securities Investors Association (Singapore) (SIAS) are increasingly taking issuers to task at AGMs and through protracted Q&A sessions. There have also been several shareholder campaigns involving issuers, including semiconductor firm Asti Holdings, which was taken to task via the courts after failing to convene an AGM for its 2021 financial year.

In Hong Kong meanwhile, retail activity was thin on the ground compared to years past. There has generally been a dearth of activism: hedge fund Elliott Management physically pulled out of Hong Kong in 2021 and its long-running battle with Bank of East Asia was one of the last shareholder campaigns of significance in the past five years.

Who is attending AGMs?

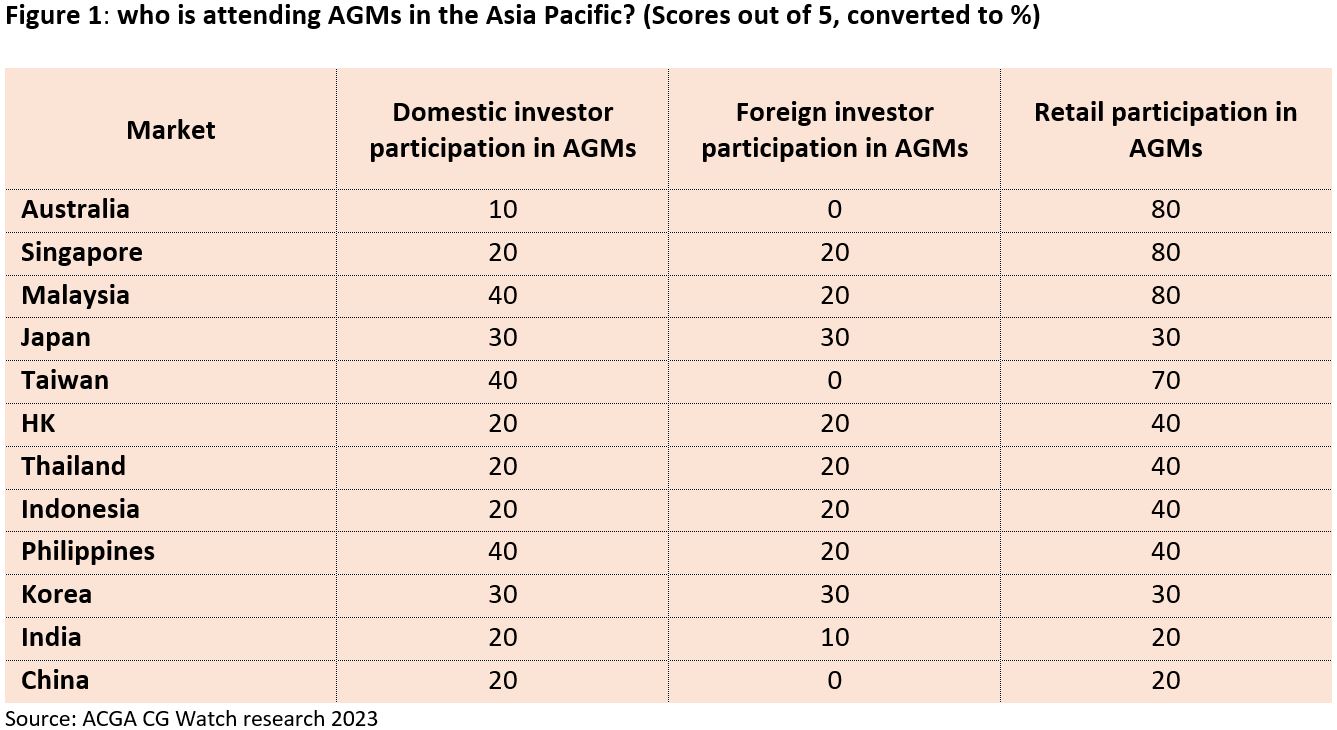

While Australia, Singapore and Malaysia boast strong retail participation in AGMs, there is not necessarily a similar theme among institutional investors. In Australia in particular there is a significant disparity in attendance between the two, and to a lesser extent, Singapore.

Overall, our survey reflects mediocre attendance by both domestic and foreign institutional investors in the region compared to their retail peers:

With additional reporting by Research Managers Stephanie Lin and Lake Wang

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Jane Moir

Jane Moir