Toyota Industries: Governance concerns persist in revised takeover

by Anuja Agarwal, ACGA

Integral to Japan’s ongoing corporate-governance reforms is for listed companies to unwind cross-shareholdings, with the Tokyo Stock Exchange (TSE) emphasising that the quality of listed companies matters more than their quantity. Against this backdrop, on 3 June 2025, Toyota Industries Corporation (TICO) unveiled a pre-conditional tender offer from Toyota Fudosan[1] at ¥16,300, a 23.3% premium to the unaffected share price (before speculative media reports emerged) but an 11.4% discount to the pre-announcement last close. According to the company, this discount was justified by a media leak prior to the tender offer bid (ToB) launch.

ACGA's July 2025 commentary[2] and subsequent open letter to the boards of TICO and Toyota Motor Corporation (TMC)[3] pointed out serious governance shortcomings in the original proposal, including diluted majority-of-minority safeguards caused by the inclusion of conflicted parties, an opaque valuation process and a neutral recommendation from TICO’s Special Committee. ACGA members had engagements with Toyota Group companies senior management and an external director of TICO to provide feedback on these issues.

Six months on from the initial bid, Toyota Fudosan's revised ¥18,800 tender offer[4] features improved transparency through voluntary alignment with the updated TSE code of corporate conduct[5] and a positive recommendation from the Special Committee to shareholders to accept the tender. The new price delivers a 42.16% premium to the undisturbed stock price on 25 April 2025, yet genuine redemption remains illusory in practice. The January 2026 tender offer documents[6] provide improved disclosures on financial model assumptions including business segment projections which are a welcome advance in transparency, but they do not resolve important governance flaws that remain in TICO’s revised tender offer.

Assessment of alignment with best practices

Sound governance practices should in principle increase the likelihood of fair pricing outcomes by addressing drivers of potential mispricing. Our analysis focuses more on governance quality and procedural fairness with a brief reference to the updated pricing outcome of the TOB for minority shareholders. We have evaluated the transaction against an objective framework based on TSE’s revised code of conduct[7] as well as the Fairness Ensuring Measures 1 to 6 set out in METI’s Fair M&A Guidelines.[8] Where any of these measures have not been implemented, we examine the stated reasons for this and consider their implications for overall fairness.

Fairness of terms of the transaction

• The process of consultation and negotiation with the acquirer

Examining the negotiation process, on 9 January 2026, TICO's board and Special Committee deemed the ¥18,600 proposal "significantly deviating" from expectations, particularly in light of rising values of TICO’s cross-shareholdings. However, four days later on 13 January, after the post-tax value of TICO’s stakes in publicly traded companies rose by ¥1,005 per share[9], the Special Committee accepted ¥18,800 and recommended that shareholders tender, following an increment of just 1% from a price that had only days earlier been rejected as insufficient. That the negotiation process reached this as the “final price” by Toyota Fudosan signals limited bargaining strength on the part of TICO’s board and Special Committee.

While Japanese corporate law requires directors to act in the best interests of the company a whole and by extension, its shareholders collectively, the handling here raises legitimate questions over the adequate safeguarding of minority shareholders’ interests in a conflicted transaction.

.jpg)

• Share value calculation details and the rationale behind the financial forecasts and assumptions used as the basis for the calculation

While the updated tender offer provides greater transparency, the advisory situation remains conflicted with only partial improvements to address the issues. The banks providing financing for this transaction (Mitsubishi UFJ Bank, Mizuho Bank and Sumitomo Mitsui Bank) have group affiliates serving as financial advisors (FAs): SMBC Nikko Securities advising TICO and Mitsubishi UFJ Morgan Stanley Securities (MUMSS) for the Special Committee. These ties create obvious vested interests in valuation exercises undertaken by some of the FAs. Toyota Fudosan did retain Nomura Securities as an advisor and TICO has EY Strategy and Consulting Co., Ltd. (EYSC) as an independent third-party appraiser. However, Nomura Securities did not give a fairness opinion. Although EYSC’s opinion is unconflicted, there is no deemed dividend[10] taxation disclosure or quantification of synergies from the transaction, even as a range or probabilistic estimates. This leaves investors without adequate visibility on future growth potential arising from the transaction.

• Reasonableness of the premium compared with past market prices and similar transactions

Shareholders have noted that the updated ToB price is still below the independent FA midpoint of sum of the parts (SOTP) valuation[11]. TICO’s most recent book value per share (BVPS) was ¥20,286, based on third quarter earnings data released on 3 February 2026, against which the updated ToB price is at a 7.9% discount[12].

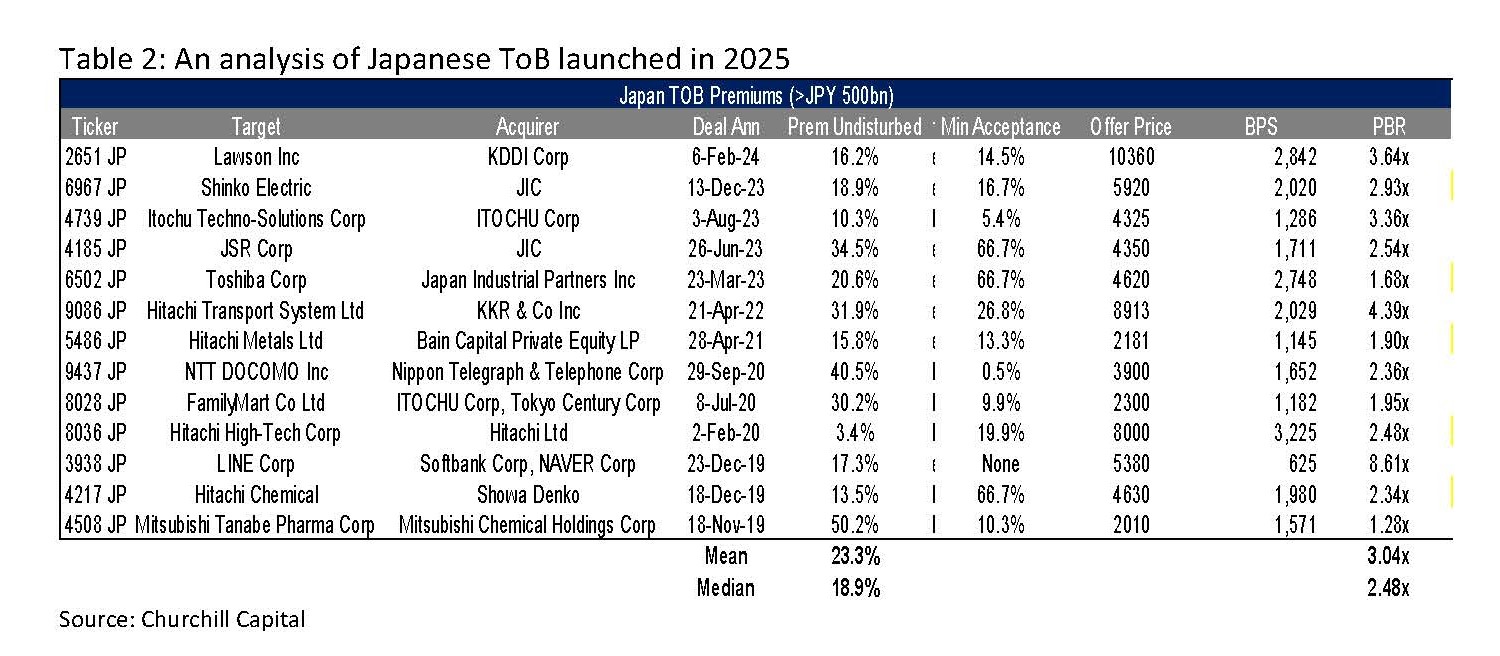

Table 2 below sets out the average premium and offer price to book value for 13 large-cap ToB transactions since the introduction of METI’s Fair M&A Guidelines in 2019. The mean premium of 23.3% (median premium at 18.9%) to the undisturbed share price is lower than TICO’s at 42.2%. Note that narrowing the timeline of this analysis, TSE has released a distribution of takeover premia after revisions of the code (July 2025) which shows the average premium for MBOs launched since July is higher at 52%[13] . However, the variance of the offer price over book value is striking: the mean for the offer price for comparable transactions has been at 3.04x BVPS (median of 2.48x) with practically all the comparable transactions at a significant premium, while TICO is being taken private at a discount to book value.

Fairness of the procedure

Below we evaluate the transaction relative to METI’s six key “Fairness Ensuring Measures”, issued in June 2019, designed to promote procedural fairness in situations where inherent conflicts of interest may arise, such as management buyouts (MBOs) and acquisitions by controlling shareholders. These voluntary guidelines are intended to address biases in decision making and protect minority shareholders’ interests.

1. Establishment of a Special Committee

While a Special Committee has been formed, questions remain about whether its members possess adequate financial and capital markets expertise to properly evaluate such a complex transaction. Investors raised concerns regarding the skill set and composition of the Committee when the ToB was first announced in June 2025; more than six months later the composition of the Committee seems to be unchanged. Of the three SC members (all outside directors), only one has direct markets experience, but in macro/FX/monetary policy rather than transactional M&A or equity valuation.[14]

Separately, it is unclear whether the Committee debated or considered the option of taking Elliott Investment Management’s standalone offer[15] as an alternative to Toyota Fudosan’s privatisation bid.

2. Expert advice from external advisors

The fairness opinions issued by the FAs are questionable due to vested interests linked to success fees. While Toyota Fudosan has Nomura Securities as an advisor and TICO has a fairness opinion from EYSC, as noted above, only EYSC provided a fairness opinion but it did not take into account dividend taxation treatment nor did it quantify synergies that might be expected to arise following from the transaction.

3. Market checks

No direct market check was conducted (e.g. no active solicitation of competing bids) while page 66 of the updated ToB documents refers only to an indirect market check[16] through public disclosure of the scheme which may theoretically have resulted in counterproposals; a passive approach which is not adequate for price discovery.

4. Majority-of-minority conditions

Dilution of the majority-of-minority[17] condition continues to be a significant governance concern on the updated ToB document. The transaction hinges on 42% acceptance from shareholders classified as "minorities" to succeed, based on Toyota Group’s view that Denso (which owns 4.93% of TICO), Aisin (2.19%), and Toyota Tsusho (5.09%)—count as independent minority shareholders. This is despite these firms having their own buyback tenders alongside bidder Toyota Fudosan (5.42%) as part of the proposal from the outset.[18]

Treating group companies as independent minorities effectively reduces the true independent threshold for a potential squeeze-out, undermining METI Fair M&A Guidelines and TSE Corporate Conduct Code protections. This is an issue which ACGA has noted relative to concerns regarding minority shareholder protections in ToB rules in Japan.[19]

In addition, Akio Toyoda is personally investing in the transaction and serves as Chairman of the Board for both Toyota Motor Corporation and Toyota Fudosan. Denso’s Representative Director is on the Toyota Fudosan board. All these apparent conflicts underscore significant shared business interests and interconnections that undeniably persist among these Toyota Group entities.

5. Elimination of coerciveness

Whilst there is no suggestion of coercion to compel shareholders to tender their shares, governance procedures and opacity undermine the ability to make fully informed decisions.

6. Disclosure of information

The revisited ToB documents provide enhanced transparency in disclosure of financial assumptions and segment forecasts relative to the initial offer. However, concerns remain regarding information asymmetry on taxation treatment, synergies and valuation details which may well hinder sound decision making by investors.

Echoes of past concerns remain

Whilst the unwinding of cross-shareholding is a positive step in line with Japan’s governance reforms, it should not come at the expense of sound governance practices or adequate protections for minority shareholders. Ultimately, Toyota Fudosan’s bid for TICO continues to lack meaningful transparency around expected synergies or underlying value creation mathematics. Rather, opaque decision-making and the absence of forward-looking disclosures will concentrate all power within an unlisted parent that escapes public scrutiny and accountability. Incremental improvements in procedure merit some optimism, however complacency is unwarranted given the serious and ongoing concerns among minority shareholder about the overall fairness and integrity of the process.

Japan's reforms are advancing with better financial transparency and many good outcomes with price discovery through competitive bidding. The Toyota transaction risks motivating other parent entities of listed subsidiaries to sidestep minority shareholder protections, eroding real adherence to METI and TSE fair M&A standards and shaking the confidence of equity market participants.

Toyota Fudosan has already secured expressions of intention to tender from other shareholders representing 4.14% ownership. Now, the market watches for what other investors do and whether this transaction ultimately demonstrates that corporate governance in Japan has evolved to protect all shareholders or remains selectively applied. Minorities deserve uncompromised process integrity.

Footnotes

[1] English language Bidder Document from Toyota Industries (6201 JP): https://www.toyota-industries.com/news/item/20250603_document_e05.pdf

English language Target Opinion Document from Toyota Industries: https://www.toyota-industries.com/news/item/20250603_document_e04.pdf

[2] https://www.acga-asia.org/blog-detail.php?id=102

[3] https://www.acga-asia.org/advocacy-detail.php?id=528&sk=&sa=

[4] https://www.toyota-industries.com/news/item/20260114_document_e03.pdf

[5] https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/sjcobq000000splj.pdf

[6] https://www.toyota-industries.com/news/item/20260114_document_e03.pdf

[7] TSE Revising the Code of Corporate Conduct on MBOs and Subsidiary Conversions, February 2025: https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/sjcobq000000splj.pdf

[8] METI Fair Guidelines: https://www.jdsupra.com/legalnews/meti-issues-fair-m-a-guidelines-and-12774/

[9] On January 13, 2026, the day before the announcement of the Revised TOB, the post-tax value of TICO’s stakes in publicly traded companies increased by ¥1,005 per TICO share, mainly driven by a +7.5% increase in the share price of Toyota Motor on the day. https://elliottletters.com/wp-content/uploads/Elliotts-Perpectives-on-Toyota-Industries-EN.pdf

[10] “Deemed dividend tax treatment” signals that, for the recipient, a portion of value arising in or around the asset sale is taxed as dividend income, not pure capital gain/asset sale income, with corresponding differences in rates, withholding, and potential reliefs (e.g., dividends received deduction for corporate shareholders)

[11] Comparable company SOTP and DCF SOTP methods are considered the most suitable for this context, as they effectively capture segment-specific value drivers.

[12] https://www.toyota-industries.com/investors/library/results/

[13] vk0khi000000lqs4.pdf

[14] https://www.toyota-industries.com/sustainability/item/20251111_cg_report_E.pdf

[15] https://elliottletters.com/wp-content/uploads/Elliotts-Perpectives-on-Toyota-Industries-EN.pdf

[16] It can be assessed that, following the clarification of the transaction scheme, terms, conditions, and other details of the Tender Offer through the publication of the Target Company press release dated June 3, 2025, an environment was established in which other potential acquirers could make counterproposals, thereby implementing an indirect market check, and that no competing proposal or proposal requesting a change to or withdrawal of the Tender Offer premised on the privatisation of the Target Company has been received.

[17] Majority-of-minority (MoM) is a key protection in Japanese M&A, especially take-private deals like TOBs or squeeze-outs, per METI's 2019 Fair M&A Guidelines and TSE's 2025 listing rule revisions. It requires tender offer success to hinge on >50% acceptance from "minority" shareholders - defined as non-controlling, unrelated parties excluding the bidder and affiliates - to prevent coerced deals and ensure price fairness.

It is voluntary "best practice," but TSE mandates explanation if omitted; special committees must assess fairness to "general shareholders." Squeeze-out: Post-TOB, 2/3 total votes (incl. bidder) approve share consolidation; minorities get appraisal rights.

[18] For background explanation, in Japanese M&A situations, the Companies Act allows for a controlling shareholder owning 90% or more of a company to buy out the remaining 10% of shares (a squeeze-out) under article 179. In article 180 there is an allowance for share consolidation by agreement of shareholders. A 10% squeeze-out is in line with best practice globally. However, Article 180 is being routinely used by companies either acquiring another company or conducting a management buyout. This takes the form of acquiring 2/3rds of the target company and then holding an EGM to change the Articles of Association to allow for a share consolidation, a change that requires a super majority. Once the motion is passed, the remining up to 1/3rd of the shares are effectively reduced to a fraction of a share and are compulsorily bought by the acquirer.

[19] https://www.acga-asia.org//pdf/2025-dec-post-japan-delegation-advocacy-commentary

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.