Nidec governance: more form, less substance

by Anuja Agarwal, ACGA

Japanese regulators often emphasize moving from form to substance, yet corporate scandals expose what the structures were supposed to prevent. Nidec is now a case study in why governance, or lack of it, is financially material: a global champion in electric motors that has been placed on the Tokyo Stock Exchange’s “Security on Special Alert”(1), deleted from the Nikkei 225 and TOPIX indices and punished with a collapsing share price.

Prior to the 2025 scandals, Nidec's board appeared formally independent on paper, with seven independent outside directors out of 11 total members (64%), exceeding Tokyo Stock Exchange’s requirements for Prime Market companies. Third-party evaluations (via an external law firm) praised the composition, diversity (gender, global experience), and candid discussions, rating oversight highly(2). On paper, it looked like part of the post-Abenomics governance success story.

The reality was less reassuring. Founder Shigenobu Nagamori's dual role as Chairman and Representative Director(3) concentrated influence, undermining practical oversight despite being structurally compliant. Accounting irregularities revealed in September 2025, across Chinese, Italian and Swiss subsidiaries – from tariff-dodging country-of-origin games to aggressive revenue recognition and delayed impairments – exposed weak internal controls and a culture where hitting growth and sales targets trumped compliance(4).

This wasn’t even the first time. According to Toyo Kezai(5) in early spring 2022, inappropriate accounting was exposed at a Brazilian subsidiary, the former Embraco Brazil (now Nidec Global Appliance Compressors Brazil), following an anonymous internal whistleblowing report (6). The documents list specific actions, which, according to the report, include the reversal of inventory valuation reserves, reversal of quality warranty reserves, deferral of expenses, unjustified price hikes attributed to rising raw material costs, and the sale of scrap to suppliers at inflated prices. Following the internal report, Nidec investigated, including a digital forensic audit of emails, in consultation with its auditing firm, PwC Kyoto (now PwC Japan). They also carried out interviews with relevant parties regarding the "orders from top management" pointed out in the whistleblowing report(7).

These were not made public, but the question is: did the board discuss the internal culture behind these shenanigans and seek to address it?

A succinct analysis of Nidec’s board

The accounting failures were not arcane derivative trades or exotic off-balance-sheet vehicles. They were the kind of red flags – persistent adjustments, inconsistent segment data followed by internal whistleblowing – that a financially literate board and a robust audit committee might have probed more deeply. The issue was less nominal independence in headcount than the quality of directors and whether enough of them had the financial and risk expertise to interrogate management and challenge the founder-driven, aggressively expansionist culture.

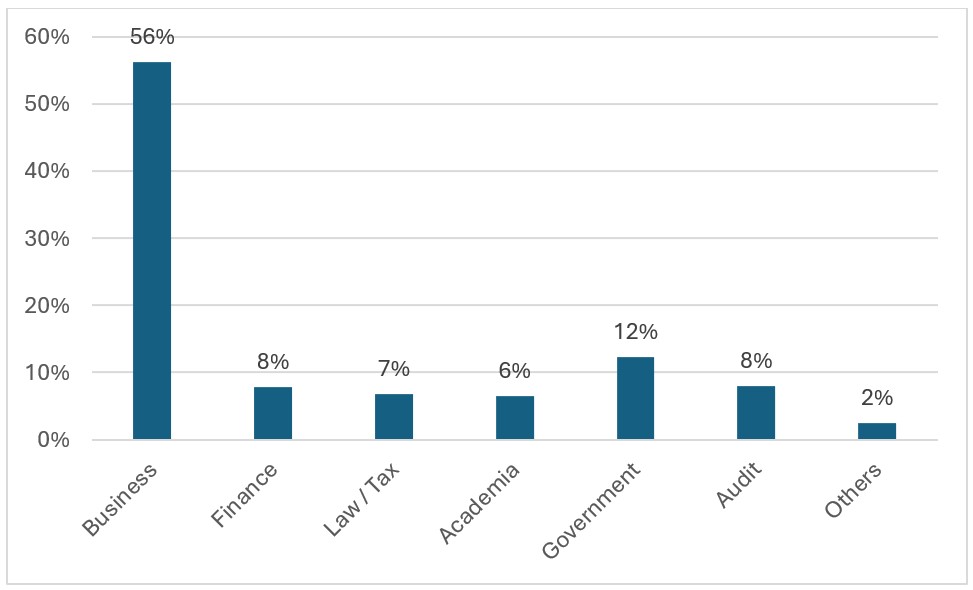

While Nidec has a board size of 11 and seven outside directors, it is notable that none of them had experience in business, audit or finance, while plenty of academics and government/legal experience is present. Nidec is a clear outlier as Chart 1 shows- 56% of outside directors in Topix100 companies had a business background(8), 8% had a finance background, while only 6% were from academia.

Extending this analysis, based on external data on TOPIX 100 companies and by our analysis, 12 appear not to have outside directors with finance, tax/law or audit backgrounds, or have outside Statutory Auditors(9) without relevant financial, accounting education, or professional expertise(10). This brings into sharp focus the need for regulators and policymakers to raise the game in the upcoming Company Act and Corporate Governance Code revisions. There is a strong case to be made to mandate financial training for directors and have more robust checks for risk management and internal controls.

Chart 1: Background of Outside Directors for Topix100 companies

Footnotes

1. https://www.jpx.co.jp/english/news/1023/20251027-12.html

2. https://www.nidec.com/files/user/www-nideccom/ir/management/governance/pdf/240703_report_en.pdf, Page 12

3. A representative director (daihyō torishimariyaku) in Japan is the senior executive position mandated by the Companies Act for joint-stock companies (kabushiki kaisha, or KK) and certain other corporate forms. This role holds the highest authority among directors, with the power to legally bind the company through contracts, judicial acts, and business decisions on its behalf.

4. https://www.reuters.com/markets/europe/japan-nidecs-accounting-probe-sparks-record-stock-plunge-2025-09-04/

5. Toyo Keizai (東洋経済新報社), founded in 1895, has credibility in Japan as a leading business magazine and online platform for data-driven economic analysis and investigative journalism.

6. Nidec, the full picture of the unknown "improper accounting" suspicion, what happened in the former Japan Dec servo and the former Embraco Brazil | News & Reports | Toyo Keizai Online; https://toyokeizai.net/articles/-/921977?page=2

7. Nidec, the full picture of the unknown "improper accounting" suspicion, what happened in the former Japan Dec servo and the former Embraco Brazil | News & Reports | Toyo Keizai Online; https://toyokeizai.net/articles/-/921977?page=2

8. The data is gathered from the companies’ Yuho and Corporate Governance reports. There is some judgement applied in making the classifications. For example, someone who spend 35 years as a bureaucrat before spending 3 years at a company as an executive is classified as a bureaucrat.

9. In Japan there is no mandatory requirement for an “expert” among the Statutory Auditors or on the Audit Committee (in the case of the Three-Committee or Audit Committee structures).

10. Data sourced from UBP Investments, Bloomberg data, ACGA Research

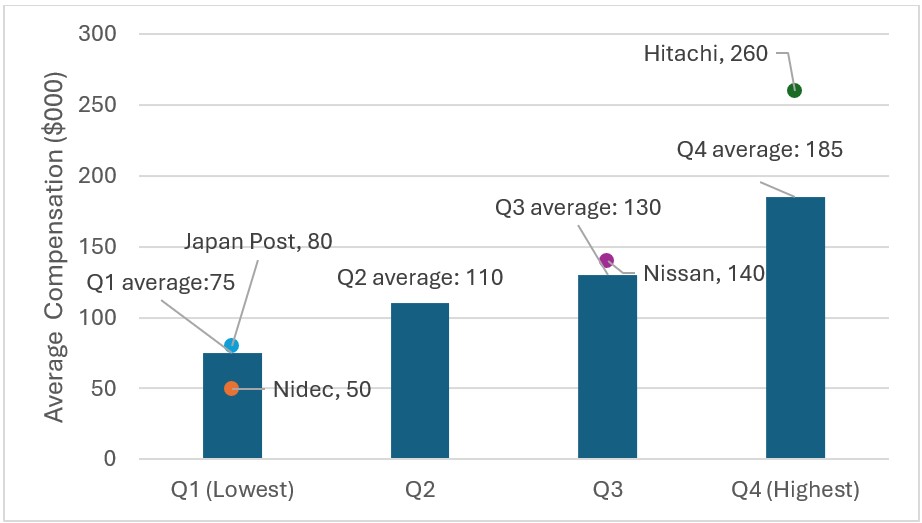

11. Total compensation from the Yuho (March disclosure of Yen 60mn) divided by the number of directors (7). This is converted into USD using FX on 23rd December and the output is displayed rounded to the nearest $10,000. The same FX is used for all Topix 100 names and the quartile averages.

12. ACGA Research, UBP, Bloomberg December 2025

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.