Japan’s corporate advisors: enduring influence, absent accountability

by Anuja Agarwal, ACGA

Despite a decade of reform and the seemingly relentless march of modernisation in Japanese corporate governance, certain traditions have proved remarkably resilient: chief among these, the continued prevalence of “sodanyaku” and “komon” advisor roles for retired senior executives. For those not familiar with the term, komon or sodanyaku are advisory positions in Japanese companies typically held by former presidents or senior executives who provide non-executive guidance without direct management duties after retirement. This facilitates continuity of influence for former executives, rarely linked to meaningful market oversight or stakeholder accountability.

In March 2017, METI formulated the “Practical Guidelines for Corporate Governance Systems” which said, “if a company retains its retired president/ CEO as its sodanyaku or komon, it is meaningful to voluntarily disclose the number of the retired presidents/ CEOs who act as its sodanyaku or komon, and their roles and other treatment plans externally (1).” The disclosure system started from early 2018 but implementation by companies has been slow. Recent figures indicate that only 42% of Prime Market companies and 27.3% of all 3,831 listed companies publicly disclose the presence of such advisors. It can be safely assumed that many of the ones that do not disclose are also continuing with this tradition (2).

These ex-representatives are not merely ceremonial relics. In the minority of firms that do disclose, 70% of advisors receive compensation, nearly a quarter serve in a full-time capacity, and a significant portion have maintained these posts for more than five years – some for over a decade. The irony is that whilst these individuals wield no formal fiduciary duty or systemic accountability, they remain capable of influencing key decisions and strategic direction (3).

Fuji Media: A case study in nominal reform

Readers would undoubtedly remember the Toshiba scandal involving many advisors which revolved around an extensive accounting fraud uncovered in 2015 (4). Fuji Media Holdings (FMH) in the 2025 proxy season has also faced scrutiny around nominal reforms of the sodanyaku title.

In the wake of reputational damage and significant financial losses, the company took steps to “abolish” the sodanyaku position as part of a wider governance reform, winning management approval at its annual meeting. However, on June 27th (5), just two days after the AGM, FMH disclosed in its Corporate Governance Report (6) that Mr. Kanemitsu, Representative Director and President until the meeting’s conclusion, had been appointed to a newly created “advisor” position with compensation. While the company had formally removed the sodanyaku title from its Articles, the substance of the new role remains unclear. The timing and lack of explanation have raised questions about whether FMH’s reforms represent genuine change or a rebranding of entrenched practices.

What does the data say about companies with sodanyaku / komon?

According to a paper published by Ishida, Ogoe and Suzuki in April 2023, retiring CEOs were found to overstate earnings to acquire an advisor post. This study was done using a sample of Japanese listed firms for 1991–2020 (7). These “ghosts of the boardroom”(8) have a harmful influence on company strategy, as they are more concerned with protecting their legacies and (potentially loss-making) passion projects rather than focusing on value creation and growth. Another paper from Ogoe and Suzuki published in June 2023 finds evidence that the presence of advisors adversely impacts accounting performance and that advisors may not be beneficial to firms or shareholders (9).

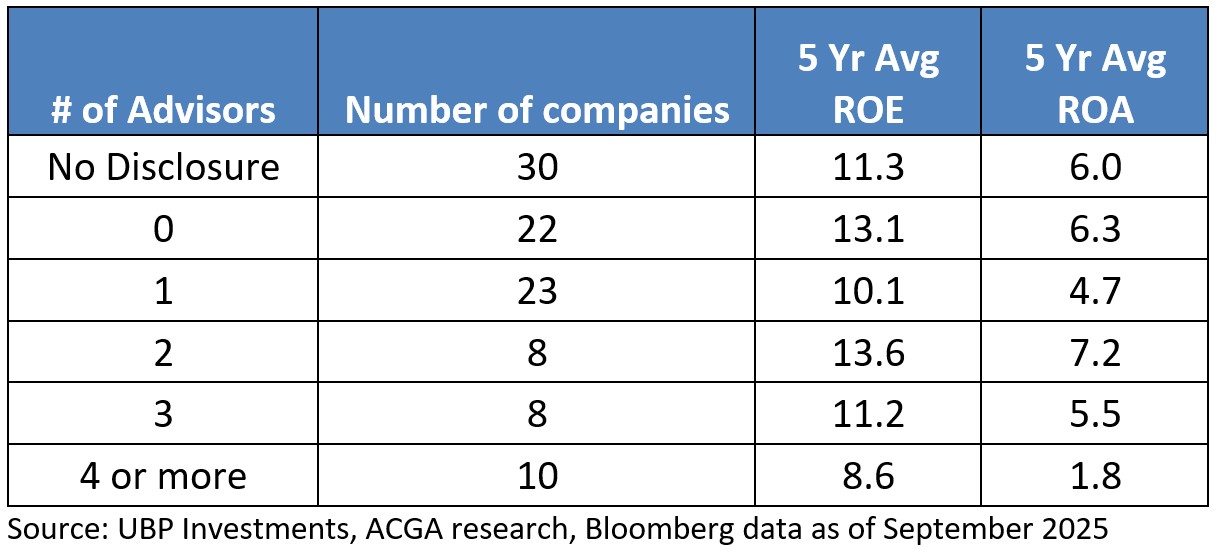

Return on Assets (RoA) and Return on Equity (RoE) can be influenced by many different factors but the data below for Topix 100 companies shows returns measured across both metrics generally reducing as the number of external counsellors increases and are lowest for those that have four or more advisors. These numbers admittedly do not provide the full picture as around 30% of companies make no disclosure, but when we arrange the raw data into four quartiles by ROE, the results are unsurprising. The highest quartile by ROE has the lowest average number of advisors and paid advisors, while the lowest quartile by ROE has the highest average number of advisors as well as paid advisors. This makes intuitive sense as advisors will often wish to continue with loss-making projects as they face no shareholder accountability. The data clearly indicates that investors may regard the number of paid advisors as a financially material corporate governance red flag.

Table 1: Return on Equity (RoE) and Return on Assets (RoA) from Topix 100 companies

Were one seeking signs of substantive governance advancement in Japanese boardrooms, the advisor system offers little encouragement. In other countries ex-CEOs may sometimes continue as short-term advisors but rarely stay on as permanent fixtures. Some may view this as a symptom of an ageing society, but once truly retired from executive positions, it would be preferable for many of these former CEOs and/or C-suite leaders become outside or independent directors on other boards where they may bring fresh perspectives and provide real corporate value rather than being a drag on the financial performance of the firms they stay on with. Indeed, this will be far more aligned with the direction of reforms in Japanese corporate governance.

Footnotes

1. https://www.nam.co.jp/english/news/npdf/jeo201805.pdf

2. White paper 2025 Tokyo stock exchange (TSE) page 89-90

3. White paper 2025 Tokyo stock exchange (TSE) page 89-90

4. https://www.reuters.com/article/business/exclusive-toshiba-probe-finds-top-executives-involved-in-company-wide-scandal-idUSKCN0PR0MY/

5. 2025 Proxy Season Review, Glass Lewis

6. Fuji Media Corporate Governance Report: https://www.fujimediahd.co.jp/ir/pdf/cgr20250627.pdf

7. https://www.sciencedirect.com/science/article/abs/pii/S0927538X23000380

8. https://www.acga-asia.org/news-detail.php?id=13

9. https://www.sciencedirect.com/science/article/abs/pii/S0927538X23001002

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.