Korea moves forward on governance reform

by Stephanie Lin, ACGA

Even with cumulative voting mandated for large-cap companies and separate elections covering two audit committee members, managers and incumbents may still have the upper hand in voting at shareholder meetings.

On 25 August, Korea’s National Assembly passed a bill that builds on earlier governance legislation enacted in July. The new law mandates the adoption of cumulative voting for large listed companies with assets exceeding KRW 2 trillion (approximately USD 1.44 billion) and expands the number of audit committee members requiring a separate election from one to two. These amendments will become effective one year after enactment, anticipated in September 2026.

As noted in our previous commentary on the recent reforms, these two measures were excluded from the July package of reforms but have now been passed despite strong opposition from the business community, marking another meaningful step forward in Korea’s corporate governance progress. Both cumulative voting and the separate election of audit committee members are designed to strengthen shareholder rights, increasing the likelihood of minority shareholders gaining board representation and enhancing board accountability.

What are the changes?

Under the previous law, at least one independent director had to be elected separately as an audit committee member. The candidate would be voted on both as an independent director and as an audit committee member under a single agenda item, with the 3% voting cap (which limits the voting power of large shareholders) applied. The recent amendment expands this requirement to two audit committee members, further strengthening the independence of the audit committee and insulating the committee from potential management influence.

Cumulative voting is intended to improve the chances of minority shareholders securing a board seat and to improve the balance of control by preventing dominant shareholders from monopolising board elections. Rather than distributing votes evenly across all candidates, shareholders may concentrate them on one or more preferred nominees. For example, if there are five seats up for election, a shareholder with 100 shares has 500 votes (100 × 5) that could be allocated entirely to a single candidate.

Although cumulative voting has long been permitted in Korea under the Commercial Code, companies could previously opt out by inserting an exclusion clause in their Articles of Incorporation (AOIs). Where cumulative voting was permitted, shareholders holding at least 1% of voting shares could request its use by providing six weeks’ notice before an annual general meeting (AGM) or extraordinary general meeting (EGM). Companies that had opted out were required first to obtain shareholders’ approval to amend the AOIs by special resolution and then seek to implement cumulative voting at a subsequent meeting—a procedural requirement confirmed by a 2025 Seoul Central District Court ruling that rejected an attempt to amend AOIs and apply cumulative voting at the same meeting.

The new amendment overrides these exclusion clauses. Shareholders holding at least 1% of voting shares in large listed companies can now request the use of cumulative voting six weeks before an AGM or EGM without first amending the AOIs, significantly lowering procedural barriers for minority investors.

Staggered boards and size caps: challenges with implementation

While these reforms are an important step, their practical impact may still be constrained by structural and operational challenges. Many companies retain defensive tactics that can blunt the effectiveness of cumulative voting. Sequencing of agenda items, for instance, allows boards to place management proposals ahead of shareholder proposals, disadvantaging minority nominees. Short notice for extraordinary general meetings (EGMs) further undermines shareholder rights; under Article 363-2 of the Commercial Code, shareholder proposals must be submitted at least six weeks in advance, yet companies are required to give only two weeks’ notice for an EGM. If an EGM is announced only 40–41 days beforehand, shareholders are effectively barred from the opportunity to submit proposals.

Board size caps present another challenge 1. While such limits are often viewed as a natural governance mechanism to enhance efficiency, in Korea they have at times been used to management’s advantage. By setting a maximum number of directors and nominating exactly that number of candidates, boards can effectively pre-empt shareholder nominations. Likewise, staggered boards—where only a portion of seats are up for election at any given time—can also dilute the intended impact of cumulative voting, as the limited number of vacancies significantly raises the hurdle for minority shareholders to secure board representation. Companies can in practice achieve this effect without explicit legal authorization: many already have directors with terms expiring in different years, and if not, they can create the same outcome through amendments to their AOIs, voluntary resignations by directors and convening of EGMs.

For example, in July 2022, the local civil organization Solidarity for Economic Reform (SER) raised concerns over Kumho Petrochemical’s EGM procedure. The company’s AOIs capped the board at ten directors and two directors’ terms were due to expire at the upcoming AGM. To control the board’s composition, management persuaded the two directors to resign early and convened an EGM with only 41 days’ notice to fill the vacancies with its own nominees. Because shareholder proposals must be submitted at least six weeks before a meeting, the short notice effectively blocked minority shareholders from nominating candidates. Consequently, only management’s two nominees appeared on the ballot and were elected. By the time of the next AGM, the board was already full, leaving no space for shareholder-nominated directors.

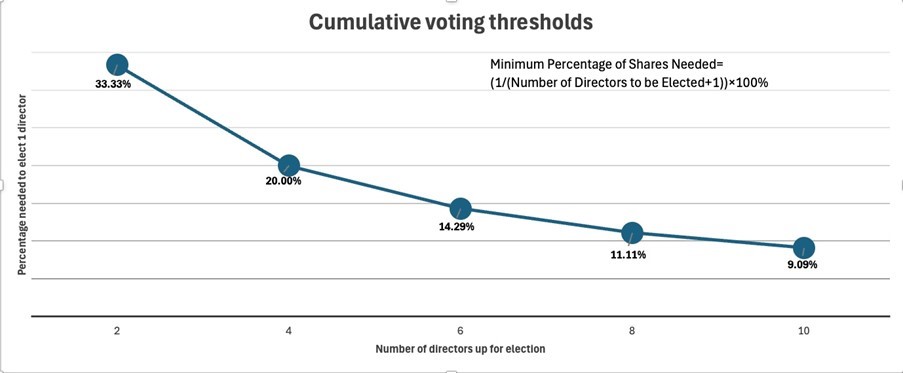

The chart below shows the minimum percentage of shares required to elect one director under a cumulative voting system.

This chart shows the minimum percentage of shares required to elect a single director under a cumulative voting system. The percentage threshold can be calculated using the formula: 1 / (Number of directors to be elected + 1)x100%. As the number of board seats up for election increases, the required percentage decreases—for example, about 33.3% of shares are needed if two directors are being elected, but only 9.1% if ten directors are contested. This highlights how cumulative voting becomes increasingly advantageous for minority shareholders when more seats are available. Source: ACGA analysis, using formula set out in “The Mathematics of Cumulative Voting” by Lewis R. Mills 2.

Several market practitioners and Korean legal experts have expressed concern that, when combined with short EGM notice periods, these tactics can effectively prevent minority shareholders from nominating even a single director, despite the availability of cumulative voting.

In addition, companies have a significant advantage over shareholders in board elections due to greater visibility into investor voting patterns through access to voting data. Through electronic voting systems and the Korea Securities Depository (KSD), management can monitor voting trends before shareholder meetings while shareholders typically know only how their own proxies were voted and lack insight into broader trends. This information advantage is critical under cumulative voting, where outcomes depend on the strategic allocation of votes, as management can use early insights into large voting blocs to rally support for their nominees.

Operational and technical hurdles described in our report “Navigating the Korean AGM Maze” further complicate the implementation of cumulative voting. ACGA members have reported practical challenges in recent AGM seasons when voting through proxy advisory firms and intermediaries. Many service providers still lack systems capable of handling cumulative voting effectively for foreign investors, forcing some to provide manual instructions for vote allocation. ACGA members have also raised concerns about whether their votes were accurately recorded—or, in some cases, counted at all—particularly when cast through complex proxy chains. These issues reduce the practical effectiveness of cumulative voting and limit minority shareholders’ ability to fully exercise their rights.

Korea’s new legislation marks a meaningful step forward for minority shareholder rights, particularly through cumulative voting and enhanced audit committee elections. However, its impact will ultimately depend on effective implementation by companies and intermediaries. Procedural, structural and technical hurdles, along with defensive practices by some companies such as board size caps, shareholder meetings called at short notice and management’s access to voting data, may present significant obstacles. Regulators, companies and shareholders will need to work collaboratively to implement these reforms effectively, ensuring that the reforms deliver on their intended promise to empower minority shareholders and strengthen governance practices of corporates.

Footnotes

1. A manual review of companies’ AOIs by the Economic Reform Research Institute, a Seoul-based think tank, in December 2008 established that about two-thirds of firms had a board size ceiling: KOSPI: 440 with size cap, 266 without; KOSDAQ: 1,154 with, 320 without.

2. https://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=2147&context=dlj

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Stephanie Lin

Stephanie Lin