China’s new blueprint for modernising the corporate system under Party leadership

by Lake Wang, ACGA

On 26 May 2025, the General Office of the Chinese Communist Party (CCP) Central Committee and the State Council jointly issued their “Opinions on Enhancing the Modern Corporate System with Chinese Characteristics”, outlining key measures to develop China’s own corporate framework 1 . That this document was issued by the highest levels of the Party and state administration underscores its symbolic importance 2 .

The concept of the “modern corporate system” (xiandai qiye zhidu 现代企业制度) was first introduced in 1993 as part of state-owned enterprise (SOE) reform, emphasising the need for well-defined ownership structures, clear accountability, the separation of government and enterprise roles, and market-oriented management. The report to the 20th Party Congress in October 2022 went beyond the SOE context, setting out a broader goal to enhance the modern corporate system with Chinese characteristics across all enterprises 3 .

Building and refining this system subsequently became a key focus during the three-year SOE reform initiative led by the State-owned Assets Supervision and Administration Commission (SASAC) between 2020 and 2022. Furthermore, in 2023, a high-level policy document aimed at boosting the private sector encouraged privately owned enterprises (POEs) to adopt the system but did not offer any guidance.

The current guidelines apply to both SOEs and POEs, providing a broad roadmap for developing a modern corporate system in China. A timeline has also been established: within about five years, the system should be widely adopted among better-resourced firms; by 2035, it is expected to be more firmly established, enhancing the global competitiveness of Chinese companies.

While the guidelines address six areas of China’s modern corporate system, including Party leadership, governance structures, corporate innovation and social responsibility, this article focuses on the role of the Party in governance and the checks and balances. A defining feature of the guidelines is the central importance of Party leadership, which imprints the modern corporate system with Chinese characteristics. Within the boundaries set by the Party, mechanisms for checks and balances—such as external directors for state-owned enterprises, independent directors and investor stewardship for listed companies—have been introduced and will undergo incremental refinement.

Party leadership imperative, requirements differ

The guidelines identify Party leadership as the cornerstone of the modern corporate system. Upholding and strengthening the Party leadership is emphasised as the cardinal principle from the outset. However, as Section One of the guidelines shows, the requirements for strengthening Party leadership differ between SOEs and POEs.

SOEs

Undoubtedly, the Party’s leadership role in SOE governance is decisive, strategic and comprehensive. The current focus is on further enhancing how the Party exercises its influence. In this regard, the guidelines emphasise the need to clearly define the role of the Party committee in discussing and deciding key corporate issues. Furthermore, they aim to enhance the efficiency and effectiveness of the Party committee’s “prior research and discussion” (qianzhi yanjiu taolun 前置研究讨论) process.

The prior discussion mechanism is key to embedding Party leadership within SOE governance. It requires major transactions and developments to undergo Party scrutiny before they are presented to the board. A 2019 regulation issued by the CCP Central Committee broadly outlines a list of such issues 4:

• Medium- and long-term corporate strategies

• Corporate restructuring, changes in ownership structure, M&A, financing activities and major investments

• Changes to the organisational structure

• Workplace safety, employees’ rights, and social responsibility matters

Despite its name, the prior research and discussion essentially functions as a form of pre-approval, frontloading the Party’s decision-making influence into the governance process. Consider the example of China Baowu Steel, a major steelmaker 5 . In 2016, the company identified 47 specific issues for its internal Party committee to deliberate on. Between 2018 and 2019, the committee reviewed 137 proposals: two were rejected, and 16 reached the board only after revisions. Notably, it vetoed a subsidiary’s plan to increase its registered capital, citing insufficient justification. Conversely, despite weak financial performance in 2017, the committee approved a budget to support China’s poverty alleviation drive, given the political importance of this national policy.

As noted by domestic CG observers, the prior discussion process tends to be more effective in larger, central SOEs than in smaller, local ones, a difference largely attributed to the former’s stronger grasp of policy matters 6 . Additionally, there is a trend towards expanding the range of issues subject to prior discussion, potentially overburdening Party committees with trivial considerations. This helps explain the guidelines’ objective to improve the effectiveness of this process.

POEs

Party leadership in POEs is less direct and pervasive compared to SOEs. Instead, the focus is on fostering mutual learning and communication between these firms and the Party. A key mechanism for this is the “consultative meeting” (kentan hui 恳谈会) held to facilitate open dialogue between Party officials and entrepreneurs.

Additionally, the guidelines encourage POEs to increase the presence of Party members and strengthen Party-building activities. As part of ACGA’s research into board diversity among the top 100 A-share issuers, we found that by mid-2023, nearly all POEs in this cohort had voluntarily established a Party committee.

Improving governance under Party leadership

If Party leadership is the foundation of China’s modern corporate system, then governance is the domain where mechanisms for external oversight are carefully established. Section Two of the guidelines addresses improving the governance structure, immediately following the section on Party leadership, which underscores the importance attached to governance within this system. Again, the requirements largely differ based on ownership type.

SOEs

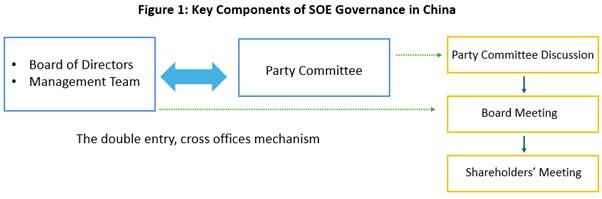

“Effective checks and balances” are a core feature of SOE governance. Among the key governing bodies, the Party committee (or organisation) oversees the strategic direction and ensures the implementation of the CCP’s policy priorities; the board is primarily tasked with strategy development and risk management; and the shareholders’ meeting functions as a mechanism for shareholders to exercise their rights.

Adapted from “Local party committee and labor cost asymmetry”, Journal of Management Control (September 2024)

Under the “double entry, cross offices” mechanism (shuangxiang jinru jiaocha renzhi 双向进入, 交叉任职 ), the Party committee secretary and the board chairman are often the same person (7) . Most members of the Party committee also serve on the board and in the senior management. This tight-knit group is likely to have already discussed key issues before any board meeting. In this scenario, who, then, could potentially provide the checks and balances required by the guidelines?

This brings into focus the role of external directors in SOEs. Introduced in 2004, external directors are board members who are not employees of the company and are nominated by the controlling shareholders (i.e., the state) 8 . In the context of SOE governance, independent directors (INEDs) form a subset of the external directors. INEDs are required to be independent from both management and controlling shareholders, whereas external directors are required to be independent only from the management. For listed SOEs, the nomination of INEDs is regulated by rules from the China Securities Regulatory Commission (CSRC).

As a result of SASAC’s three-year SOE reform (2020-2022), a total of 38,000 SOEs—at both central and local levels—had established boards by early 2023, with external directors holding a majority of seats in nearly all cases 9 .

In practice, many external directors are retired SOE executives. Concerns remain about how effectively they can fulfil their monitoring role and avoid becoming merely token board members, vividly described in Chinese as “vase” [i.e., decorative] directors (huaping dongshi 花瓶董事). Seemingly in response to this concern, the guidelines stress the need to strengthen the mechanisms for assessing and incentivising external directors.

POEs

The guidelines do not explicitly mention checks and balances when outlining governance requirements for POEs. Nonetheless, they encourage POEs to strengthen their governance frameworks, with a particular emphasis on regulating the behaviour of controlling shareholders and de facto controllers.

Listed companies

The key message for listed companies, regardless of ownership, is the implementation of rules regarding independent directors which require strict implementation. In particular, the guidelines emphasise having audit committees composed primarily of INEDs and the requirement for INED-only meetings.

China overhauled its INED system in 2023, a reform marked by the issuance of the “Measures for the Administration of Independent Directors of Listed Companies” by the CSRC in August that year. The measures require INEDs to hold at least one-third of the board seats and to comprise at least half the members of audit, nomination and remuneration committees. Moreover, potential conflicts of interest, such as related party transactions (RPTs) or proposals to change or waive undertakings, must be approved by INEDs in meetings attended exclusively by them.

Lastly, the guidelines recognise the role of investors in driving forward corporate governance standards. Specifically, listed companies are encouraged to view institutional investors with holdings of 5% or more as “active shareholders”. The guidelines do not specify whether this definition is based on total shares or the free float. Under China’s recent rules on mutual fund stewardship, funds holding 5% or more of a company’s free float are required to vote on 13 types of corporate matters, including director elections and dismissals, executive remuneration, RPTs, M&A and sustainability initiatives 10 .

Going forward, SASAC and the CSRC will push for the adoption of the guidelines among SOEs and listed companies, respectively, while the All-China Federation of Industry and Commerce (ACFIC), a state-backed chamber of commerce, will issue further guidance for POEs.

Footnotes:

1. https://www.gov.cn/zhengce/202505/content_7025304.htm

2. The document was approved by the Central Comprehensively Deepening Reform Commission (zhongyang quanmian shenhua gaige weiyuanhui中央全面深化改革委员会), a policy-making body within the CCP, in June 2024. However, it has only recently been made public.

3. https://www.idcpc.org.cn/english2023/tjzl/cpcjj/20thPartyCongrssReport/

4. https://www.gov.cn/zhengce/2020-01/05/content_5466687.htm

5. https://www.12371.cn/2019/07/18/ARTI1563416047296208.shtml

6. https://www.cssn.cn/fx/xr/202402/t20240222_5734268.shtml

7. This mechanism allows Party committee members to serve on the board and in management, and vice versa. Additionally, the Party secretary and the board chair are generally the same person.

8. External directors may serve on either a full-time or part-time basis, with both types appointed by the SASAC.

9. https://www.gov.cn/xinwen/2023-02/01/content_5739479.htm

10. https://www.amac.org.cn/xwfb/tzgg/202505/P020250509630213513484.pdf

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Lake Wang

Lake Wang