China aligns CG rules with the Company Law

by Lake Wang, ACGA

On 27 December 2024, China’s CSRC amended a series of regulations. The latest rule changes scrap supervisory boards in listed companies, lower the bar for shareholder proposals, and strengthen the roles of controlling shareholders and INEDs. Less positive are the further formalisation of dual-class shares and lack of clarity on Party Committees.

The changes are primarily intended to align with the Company Law that came into effect on 1 July 2024 (“the 2024 Company Law”). The key revised regulations include the Guidelines for Articles of Association of Listed Companies (“Guidelines”) and the Rules for the Shareholders’ Meetings of Listed Companies (“Rules”). The amendments are open as a public consultation until 26 January.

While characterised by the CSRC as mere “adaptive adjustments”, the revisions address some key aspects of China’s CG framework. They abolish supervisory boards for listed companies, lower the threshold for shareholder proposals, and strengthen the roles of controlling shareholders and independent directors (INEDs). Less positively, they further formalise dual-class share structures. And conspicuously absent from the amendments is clarity regarding the role of Party Committees within listed companies.

Farewell, supervisory boards

The 2024 Company Law introduced the option for companies to replace their supervisory boards with audit committees. The proposed amendments now go further, eliminating the need for supervisory boards in listed companies. Article 133 of the Guidelines states that the board “establishes the audit committee, which exercises the powers and duties of the supervisory board as stipulated in the Company Law.” Accordingly, the authority to call an EGM, previously held by supervisory boards, has been transferred to audit committees (Article 53, the Guidelines). The proposed deadline for phasing out supervisory boards for issuers is 1 January 2026.

Supervisory boards, a fixture of China’s two-tier board structure introduced with the 1993 Company Law, have long been regarded as an ineffective layer of oversight. In our 2018 report on China, “Awakening Governance,” we recommended either strengthening supervisory boards or phasing them out.

The proposed amendments, however, do not touch on Party Committees, in particular the lack of transparency over their role and relationship with the board. Article 13 of the Guidelines, which requires issuers to provide “necessary conditions” for Party activities, remains unchanged.

Lower bar for shareholder proposals

The threshold for submitting shareholder proposals has been lowered from 3% to 1%. This means that shareholders holding over 1% of a company’s shares, either individually or collectively, will be able to submit interim proposals to the board 10 days prior to the shareholder meeting (Article 15, the Rules). A similar 1% threshold is also in place in Taiwan, though with stricter requirements on proposal length (Article of 172-1, Company Act).

Between 2022 and mid-2024, minority shareholders in China submitted 14 proposals, 13 of which focused on director or supervisor nominations, according to a recent report by Fidelity and ZD Proxy. We note that some issuers have raised barriers to shareholder participation. For example, Northeast Pharmaceutical and Wedge Industrial require a 10% shareholding to nominate directors. The amendments explicitly prohibit issuers from raising the minimum threshold (Article 15, the Rules)

“Dual controllers” in the spotlight

The amendments also place greater accountability on controlling shareholders and others that exert actual control, collectively referred to as “dual controllers.” What was previously a single article has been expanded into an entire section (Article 42–45, the Guidelines).

Article 43 outlines acceptable and unacceptable practices for these key actors, covering areas such as information disclosure, the handling of company assets, insider trading and related party transactions. Importantly, this article extends the duty of loyalty and diligence to controlling shareholders and “actual controllers” who influence company affairs but may not hold director positions. Meanwhile, Article 44 encourages issuers to set limits on share pledging by controlling shareholders.

Other notable amendments

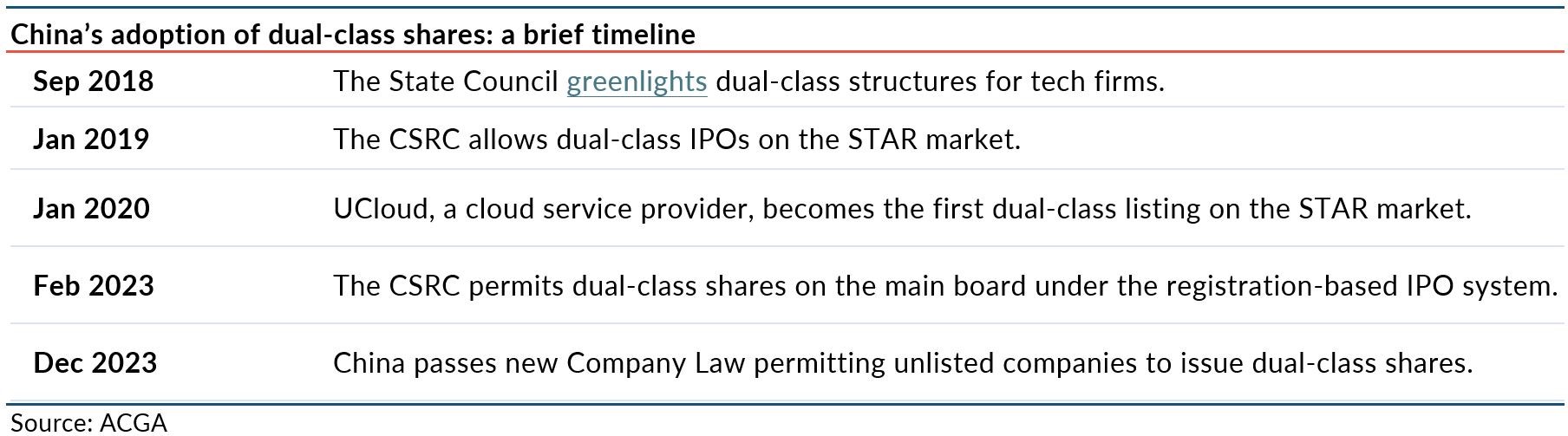

• Dual-class shares: A newly added note in Article 17 of the Guidelines explicitly requires issuers with different classes of shares, including dual-class shares, to specify measures protecting minority shareholders in their articles of association. This is in addition to providing other essential information about different share classes. Detailed parameters for dual-class shares (or “shares with special voting rights”) can be found in the listing rules of the Shanghai and Shenzhen Stock Exchanges.

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Lake Wang

Lake Wang