China and the art of giving

by Stephanie Lin, ACGA

PRC tech firms listed in Hong Kong and New York are using company coffers to align with Beijing policy on wealth redistribution, but at what price to shareholders, asks ACGA Research Manager Stephanie Lin.

China’s tech giants have taken corporate philanthropy to new heights over the past 12 months, earmarking large sums of company cash for worthy causes.

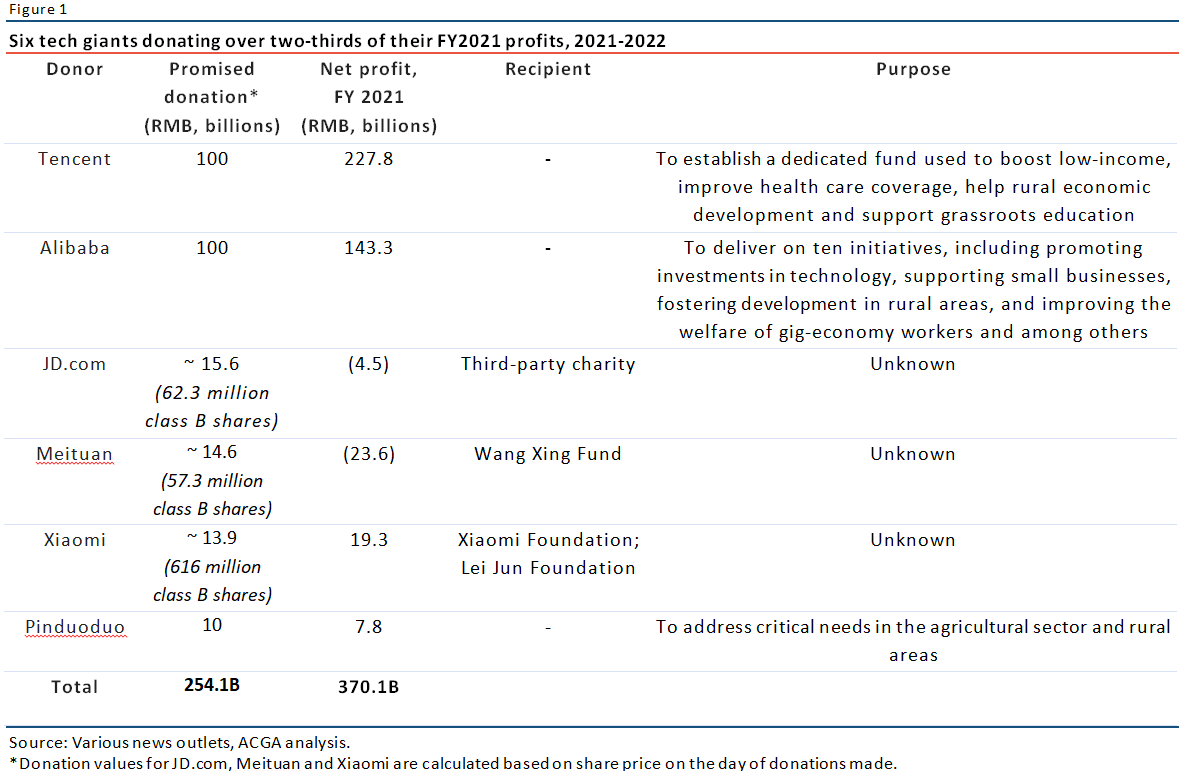

Six of these firms—including Hong Kong and US-listed e-commerce giants Alibaba and JD.com, as well as Hong Kong-listed Tencent—have either pledged or donated RMB 254.1 billion (USD37.8 billion) since August 2021 when President Xi Jinping called for “common prosperity,” a spread of wealth from the elites to the masses. The generous sums represent a liberal slice of annual profits: in Alibaba’s case, 70% of the company’s 2021 figure, and for Tencent, 44%. In total, these six companies gave away more than two-thirds of their 2021 profits.

Yet shareholder approval is not required for these bequests as Hong Kong rules only catch large-scale and connected transactions, not donations. And disclosure of the issuers’ generosity has been patchy. Issuers such as JD.com and Hong Kong-listed delivery platform Meituan disclosed their donations as material, price-sensitive information, while others did not, even as their share prices fell on the news.

In China meanwhile, regulators have tightened rules to give shareholders more say over corporate donations. In January 2022 the Chinese Securities Regulatory Commission (CSRC) required companies to seek shareholder approval for any external donations. Since then, 1,405 issuers in the PRC have revised their constitutional documents to give effect to the requirement according to figures from shareholder services firm ZD Proxy. This underpins a corporate social responsibility culture which unlike the West is increasingly orchestrated by the state, rather than by consumers.

Followers of the prosperity gospel

President Xi Jinping eulogized the concept of “common prosperity” during the 10th Chinese Community Party Central Committee for Financial and Economic Affairs in August 2021, defining the policy as the core of the party’s governing foundation. He specifically referred to promoting high-quality development, raising incomes of low-income groups, and reducing the widening wealth gap. The campaign also included a pledge to “reasonably regulate excessively high incomes and encourage high-income people and enterprises to return more to society.”

As part of its wealth-levelling strategy, Beijing also explicitly encouraged high-income businesses and individuals to give back to society through “tertiary wealth distribution,” which meant voluntary charitable donations.

Corporations quickly took their cue, battered by a series of policy changes—from curbing tax evasion and limiting monopolistic practices, to banning for-profit tutoring and restricting minors’ daily time on video games. The tech industry suffered an especially severe blow with trillions written off the value of these stocks.

Firms seeking to atone responded with gusto, eager to show loyalty and commitment to the campaign by making sizeable donations.

Tencent committed RMB50 billion (USD7.4 billion) to social responsibility efforts which boost low-earners, improve health care and promote rural education. This added to the RMB50 billion the company had already put into its “Sustainable Social Value” fund in April 2021.

Alibaba, listed in Hong Kong and New York, also allocated RMB 100 billion (nearly USD15 billion) in September 2021 to fund initiatives by 2025 to promote the policy. The figure was a few billion shy of the company’s net profit of RMB 143.3 billion (USD21.4 billion) for the whole year.

Online commerce giant Pinduoduo, listed on Nasdaq, also launched a RMB10 billion (USD1.5 billion) initiative in August 2021 to help develop agriculture and farmer welfare. It went so far as to allocate all profits from the second quarter of 2021 and any future profits to the initiative until the RMB10 billion commitment was fulfilled.

Meanwhile tech billionaires such as Richard Qiangdong Liu, former CEO and 13.8% shareholder (although he has 76.1% of the total voting power) of e-commerce firm JD.com, opted to transfer around RMB15.59 billion (USD2.3 billion) worth of his stake to a third-party charity in February 2022. The name of the charitable foundation was not disclosed in the company’s announcement. In August 2021 Wang Xing, CEO of the Hong Kong-listed food delivery company Meituan, also donated around RMB14.6 billion (USD2.1 billion) worth of shares to his charity fund, WangXing Foundation. It was not disclosed how these donations will be used.

No shareholder consent required?

While the donation amount constitutes a significant portion of these companies’ annual profits, limited discussions with shareholders took place. Neither Tencent nor Alibaba held a shareholder meeting to discuss their charitable decisions, although the latter did hold a press conference after the fact to elaborate on its donation strategy. Nasdaq-listed Pinduoduo’s RMB10 billion initiative did get shareholder approval at a September 2021 EGM despite well-exceeding its RMB7.8 billion (US$1.17 billion) profit in 2021.

In the Hong Kong context, donation disclosure is voluntary and does not require approval. Listing rules only require that large transactions (principally acquisitions and disposals) have shareholder consent, but charitable donations do not fall under the definition of a “transaction.”

Both JD.com and Meituan made disclosure pursuant to Securities and Futures Ordinance requirements on information deemed material and potentially price-sensitive. Indeed, the share price of several of these tech stocks dropped on news of the large donations. Bloomberg reported on 3 September 2021 that stocks of seven listed companies who gave details of donations and pledges were sold off in the trading session following the news. Meituan for example dropped as much as 1.7% while Tencent and Alibaba were down 0.8% and 0.7% respectively.

Are we there yet?

Common prosperity may have appeared to have fallen off the radar amid China’s Covid and economic woes of late but it is worth stressing that the policy has been touted as a long-term development goal. Xi specifically set a timeline to make essential public services available and equal to everyone in 2035 and to “achieve” common prosperity by 2050. The recent republication of Xi’s remarks on “common prosperity” on the party’s flagship journal, Qiushi, also serves as a reminder that the campaign is still in its infancy. Companies will be expected to carry out corporate social responsibility initiatives that align with the national development agenda.

This puts Chinese companies in a dilemma as they find themselves caught in between an investor base that demands a greater return for their investments and a business environment where alignment with the government’s priorities is strongly encouraged.

Generosity may be harder to justify when the bottom line takes a hit, as Tencent’s first quarterly revenue for 2022 did (its growth flatlined). While the RMB100 billion it earmarked for charity last year was only half of its RMB227.8 billion (USD34 billion) profit for 2021, it looks exuberant when you are laying off staff to reduce losses.

For further information please contact Stephanie Lin: stephanie@acga-asia.org

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Stephanie Lin

Stephanie Lin