Hong Kong: one market, two systems?

by Jane Moir, ACGA

Plans to further relax entry requirements for secondary listings will deepen a regulatory divide.

A burgeoning group of secondary-listed firms including Alibaba, JD.com and NetEase who enjoy a slew of waivers from market rules now account for nearly a sixth of Hong Kong’s total market cap of HK$52 trillion.

Their ranks are set to increase as HKEX proposes to lower entry thresholds for secondary issuers in a bid to lure further “homecoming” listings of large China firms who trade in the US.

Under HKEX’s plan, these firms will also be able to directly primary list here and keep their existing WVR or VIE structures. They will not have to comply with specific shareholder protections currently in the Listing Rules for WVR companies. ACGA has set out its concerns over the proposed move in a submission to HKEX.

We are urging HKEX to revisit the automatic waiver regime, particularly where it is apparent that the corporate governance in their qualifying exchange or places of incorporation is not on a par with Hong Kong.

We are concerned that a growing number of companies will be playing by a different set of rules. Secondary issuers enjoy waivers from the takeovers code, notifiable and connected transactions rules, the CG Code and ESG reporting requirements: in all, there are 77 waivers which are automatically granted on the basis that these firms follow equitable standards of governance on their primary exchange.

However, in many cases this is simply not the case. And as the size and influence of these issuers in the market grows, there is an increasing divide between the lower governance standards they follow compared to their primary-listed peers.

Primary listed over there but trading more here

Secondary listings were a rarity in Hong Kong prior to December 2017 when HKEX unveiled its New Board Concept Paper Conclusions: it would expand the listing regime to include companies with WVR and modify existing rules to create a new secondary listing route “to attract innovative issuers that are primary listed on a qualifying exchange.’’

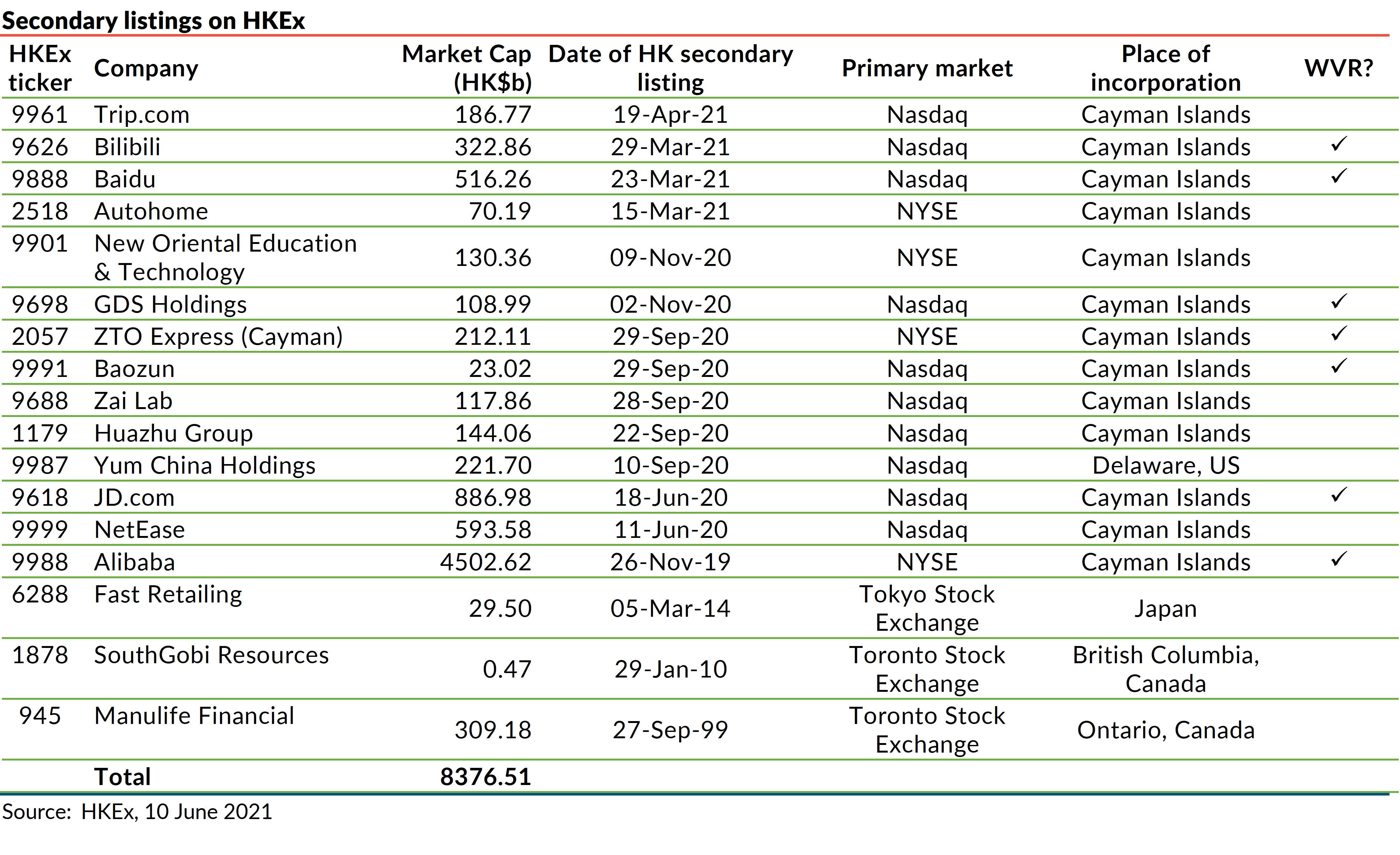

HKEX further consulted in February 2018 on a listing regime for companies from emerging and innovative sectors. A new concessionary route for these firms was thus opened up. Alibaba led the charge: since it secondary listed in November 2019, a further 13 issuers have followed suit, including NetEase, JD.com, Baozun, GDS Holdings, Baidu, Bilibili and Trip.com.

These firms now account for HK$8,376 billion in combined market cap, close to a sixth of Hong Kong’s total market cap of HK$52 trillion. Shares in these companies are moreover increasingly migrating to Hong Kong. For example, Alibaba shares traded in Hong Kong accounted for 2.5% of the company’s total issued stock when the company secondary listed here. The figure is now 20.7%.

A HKEX investor presentation in April 2021 noted that Alibaba, NetEase and JD.com contributed to around 6% of the Hong Kong market’s average daily trading in the first quarter of 2021.

Stock marker “S” for special?

Despite their size and growing influence in the market, these companies follow much lower governance standards as primary issuers. The takeovers code is waived for all secondary issuers. In addition, automatic waivers from the Listing Rules include the following:

• Notifiable transactions (entire chapter)

• Connected transactions (entire chapter)

• CG Code and CG Report (entire chapter)

• ESG report

• Advances to entities, financing arrangements

• Issues under a general mandate

• Shareholder meeting requirements

• Director’s dealings

• Appointment/removal of auditors

• Share option schemes

According to HKEX, secondary issuers are “principally regulated by the rules and authorities of the jurisdiction where they are primary listed.’’ Entire chapters of the Listing Rules are thus waived on the basis that these firms are subject to similar regulations in their primary exchanges—usually the US.

However, the governance rules they follow tend to be less stringent than those mandated for primary issuers in Hong Kong. Many of the companies are classified as “foreign private issuers” in the US, which allows them to enjoy exemptions from several NYSE and Nasdaq rules.

For example, takeover and merger rules do not apply to foreign private issuers, who can rely on their home country practice—usually the Cayman Islands. Likewise, while US-listed firms must get shareholder approval for certain share issues, their foreign private peers are exempt. They also generally have to disclose less than their domestic counterparts and are not even required to hold annual shareholder meetings. JD.com will hold its first AGM in 2021, seven years after it listed in the US. Baidu has not held an AGM since 2008.

Equivalent standards in their primary market? Not quite

In theory, secondary issuers in Hong Kong must be able to show that they have equivalent standards of governance through a combination of regulation on its primary exchange or country of incorporation, and by embedding shareholder protections into their constitutional documents.

Yet in practice such equality is lacking. Secondary issuers such as Alibaba, JD.com and NetEase are required by US regulators to make annual disclosure of any significant—but not all—differences in corporate governance practices that exist by virtue of their private foreign issuer status.

These disclosures show where these issuers ultimately follow home country practice, which is usually Cayman Islands law. Shareholder voting and the nomination, election and removal of directors is governed by home country practice, and these issuers are not subject to SEC rules on the distribution of proxy statements ahead of shareholder meetings.

While directors of domestic US issuers must disclose individual compensation and make public its policy on executive compensation, foreign private issuers are only required to do so if the home jurisdiction requires it. The US does not have specific rules for ESG disclosure.

Connected transactions meanwhile are generally governed by local and federal laws in the US, but foreign private issuers are only required to disclose in their annual Form 20-F filed with the SEC those transactions in which directors and their immediate family members have a direct or material interest. No specific transaction amount is specified, unlike domestic US companies who must report on deals in excess of US$120,000.

While loans to officers and directors are prohibited under Sarbanes-Oxley, foreign private issuers do not need shareholder approval for equity compensation plans, meaning that firms can receive a waiver from rules relating to stock option plans both in Hong Kong and the US. The Cayman Islands has no regulation in this respect.

For takeovers, secondary issuers effectively follow Cayman Islands law. In Hong Kong, a key provision of the takeovers code is a requirement for a mandatory offer if acquiring 30% or more of the voting rights of a company. There is no equivalent rule in the US and in any case, foreign private issuers are allowed to follow home practice.

Under Cayman law, any takeover would require shareholder approval by special resolution at an EGM. The offer must be approved by at least 90% in value of the shares affected, while a merger requires two-thirds of votes cast.

Another example of where these companies choose to follow home country practice is in respect of shareholder meetings, as well as boardroom independence and oversight. For example, US market rules require majority independent boards, but foreign private issuers can follow home country practice (and there is no such requirement). The same applies for compensation and nomination committees, which US rules mandate should be fully independent.

Other notable exceptions to the US rules which have been disclosed in secondary issuers’ most recent annual statements include:

Alibaba and Trip.com do not have a majority independent board and both defer to Cayman law on the issue of equity compensation plans.

Bilibili follows Cayman Islands law on equity compensation plans.

Baidu has not held an AGM since 2008. In 2018 the board approved a share incentive plan, but it relied on home country practice and did not convene a shareholder meeting to approve it.

Autohome follows home country practice in lieu of having a majority independent board, as well as a fully independent nominating, compensation and corporate governance committee. The company’s articles also allow its board to issue preferred shares without shareholder approval.

New Oriental Education does not have a majority independent board but it has a fully independent audit, compensation and nominating and corporate governance committee. It did not seek shareholder approval for its 2016 share incentive plan.

GDS Holdings relies on exemptions from US rules requiring a majority independent board, and fully independent compensation/nomination/corporate governance committees. It also does not have a regularly scheduled executive session of independent directors each year.

ZTO Express is one of the exceptions: it does not rely on home country exemptions from following US corporate governance standards.

Baozun did not hold AGMs from 2017 to 2020. It will hold an AGM each year from 2021. The company does not have a majority independent board. The company did not seek shareholder approval for an amendment in 2016 to its share plan.

Huazhu does not have a majority independent board. It also does not disclose in its annual report or website the material terms of all agreements or arrangements between directors and other persons relating to compensation or payments in connection with their role as a director.

JD.com has yet to hold an AGM.

NetEase adopted restricted stock unit plans without seeking specific shareholder approval, as Cayman Islands law does not require it to do so.

Download File Disclaimer

In addition to the ACGA website disclaimer access to the "Members' Area" of the ACGA website is subject to the general disclaimer and content attribution statements below.

General Disclaimer

By logging into our Members' Area you acknowledge that all materials displayed on the site or made available for download are for the exclusive use of ACGA members. You may not share the content with parties outside of your organisation.

Content Attribution

The copyright ownership of all material on our website belongs to ACGA. Should you wish to use any materials in the course of your corporate research, including directly quoting or paraphrasing sections, reprinting, reproducing or the like, we request that you give proper acknowledgement to ACGA and share a copy with us. Please email irina@acga-asia.org.

Jane Moir

Jane Moir